In crypto trading, prices move fast, sometimes faster than you can click “buy” or “sell.” Slippage happens when the price you expect to pay (the expected price) is different from the actual executed price your order gets filled at.

This gap may be small in stable markets, but in highly volatile conditions, it can be significant, affecting both profits and losses. For traders, especially in crypto’s 24/7 environment, understanding slippage is critical.

It’s not just a technical detail; it directly impacts how much you pay when buying crypto or how much you receive when selling. Ignoring slippage can mean missed opportunities or even substantial losses.

What Is Slippage in Crypto?

Slippage in crypto trading refers to the difference between the expected price of a trade and the actual executed price at which the order is filled. This happens because markets move quickly, and by the time your order is processed, the price may have shifted.

For example, imagine a trader placing a buy order for

Bitcoin at $120,000. If the order executes at $120,400, the trader experiences negative slippage, paying more than expected.

On the other hand, if the trade executes at $119,600, that’s positive slippage; the trader benefits by paying less.

Slippage applies to both buy and sell orders:

• Buy order: You may pay a higher (negative slippage) or lower (positive slippage) price than intended.

• Sell order: You may receive less (negative slippage) or more (positive slippage) than expected.

In short, slippage reflects the price difference between when you place a trade and when it actually executes.

Why Does Price Slippage Occur in the Crypto Market?

Slippage doesn’t happen randomly; it’s usually the result of specific market conditions that make it harder to execute a trade at the exact price you want. In crypto, four main factors drive slippage:

1. Market Volatility: If Bitcoin is trading around $120,000, a sudden surge in demand could push the price to $120,800 within seconds. A buy order placed just before may fill at the higher level.

2. Low Liquidity: Major coins like BTC or ETH have deep liquidity, keeping slippage low. Smaller altcoins with fewer buyers and sellers may slip even on modest orders.

3. Network Congestion: Heavy trading volumes can delay blockchain confirmations, causing your order to fill at a different price.

4. Large Orders: Buying or selling in bulk (e.g., 100 BTC) often consumes multiple order book levels, pushing execution further from your intended price.

Understanding these causes is the first step to managing slippage effectively, which makes calculating and tracking it even more important.

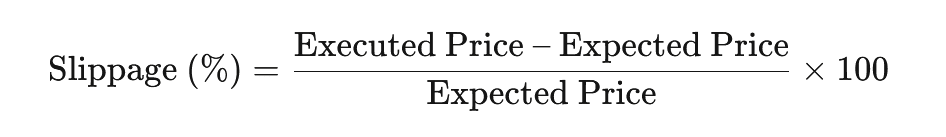

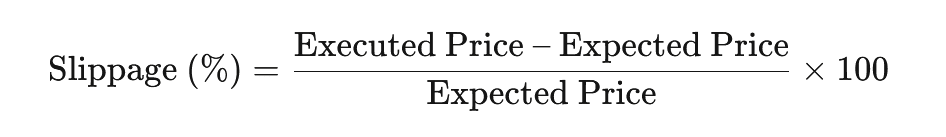

How to Calculate Slippage

Slippage is usually expressed as a percentage difference between your expected price and the executed price:

Example with Bitcoin:

• Expected price: $120,000

• Executed price: $120,600

Slippage = (120,600–120,000) ÷ 120,000 × 100 = 0.5% negative slippage

If the order had instead been executed at $119,400, the calculation would show –0.5%, meaning you benefited from positive slippage by paying less than expected.

Even small percentages matter. For large positions, a 0.5% slippage could mean thousands of dollars in unexpected costs or gains.

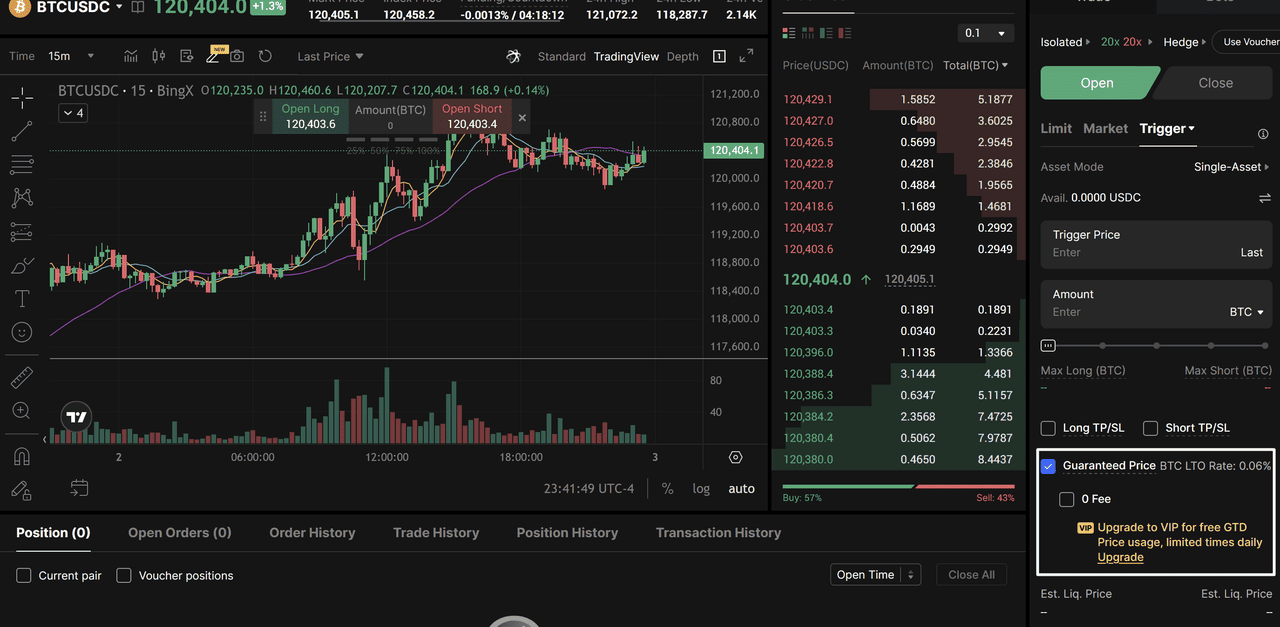

How to Trade Without Slippage Via BingX Guaranteed Price

While most platforms only help you reduce slippage, BingX takes it one step further with its exclusive

Guaranteed Price (GTD Price) feature for Perpetual Futures.

How it works:

• GTD Price ensures your trade is always executed at your preset price, no matter how volatile the market gets.

• It applies to both Trigger Orders and

Stop Loss Orders, giving traders extra protection during flash crashes or sudden spikes.

• BingX absorbs the slippage risk for you, charging only a small fee if the GTD feature is triggered.

Example: Suppose Bitcoin is trading at $120,000 and you set a Guaranteed Stop Loss at $118,500. If a flash crash drives the price to $117,900, your position will still close exactly at $118,500, not lower.

Key Advantages of Guaranteed Price

• Eliminates negative slippage risk.

• Offers smoother execution in volatile markets.

• Available across 150+ trading pairs, including BTC, ETH, XRP, SOL, and BNB.

• Currently available at a discounted fee rate for a limited time.

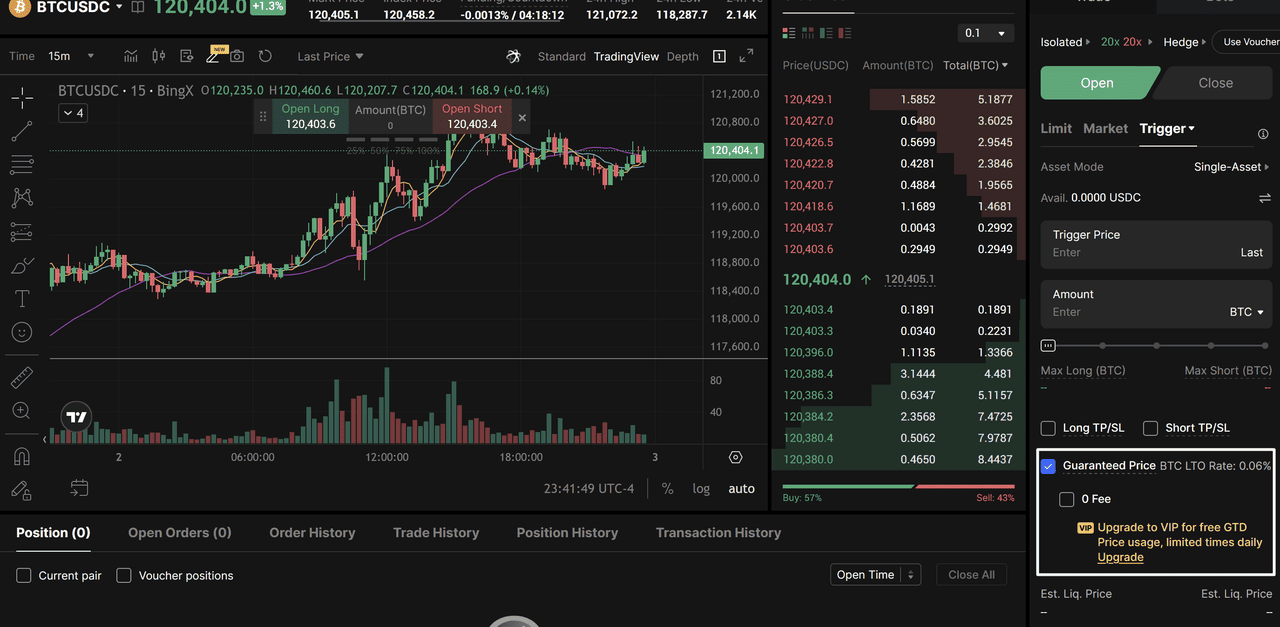

BingX Trading Panel with Guaranteed Price Option - Source: BingX

How to Use GTD Price on BingX

1. Open a trade in Perpetual Futures and choose Trigger Order or Stop Loss Order.

2. Enter your preset execution price.

3. Tick the “Guaranteed Price” checkbox in the order panel.

4. Confirm and place the trade; BingX guarantees your order will be executed at that exact price.

Strategies to Reduce Slippage in Crypto Trading

Even with BingX, traders should combine platform tools with smart execution habits. Here are the most effective strategies:

1. Limit Orders Over Market Orders

Market orders fill instantly, but they may execute at worse prices if the order book shifts. A limit order, on the other hand, ensures your trade only goes through at the exact price you set or better. On BingX, limit orders are an essential way to manage execution risk in volatile markets.

• Market orders = faster fills but higher slippage risk

• Limit orders = precise execution at your chosen price

• Example: At $120,000 BTC, a 0.5% slippage on 2 BTC = $1,200 extra cost avoided with a limit order

2. Control Execution With BingX Guaranteed Price

BingX takes execution control further with its Guaranteed Price (GTD) feature, exclusive to Perpetual Futures. GTD ensures that your Trigger Orders and Stop Losses always execute at your preset price, even if the market gaps violently. This eliminates slippage altogether, a feature that most exchanges can’t offer.

• Works for Trigger Orders and Guaranteed Stop Loss (SL)

• Locks execution at your chosen price, no matter volatility

• Example: Stop-loss at $118,500 BTC executes there, even if price plunges to $117,900

3. Trade During High Liquidity Periods on BingX

Liquidity plays a big role in slippage. On BingX, trading major pairs like BTC/USDT or ETH/USDT during peak global sessions, when both U.S. and European traders are active, means tighter spreads and better execution. BingX’s deep liquidity pools ensure orders are matched smoothly, even in volatile conditions.

• High-liquidity windows = smaller bid-ask spreads

• Major pairs (BTC, ETH, XRP) see the best execution during U.S.–EU overlap

4. Avoid News-Driven Volatility

Even on BingX, large market shocks, like ETF approvals, Fed decisions, or exchange announcements, can cause sudden price gaps. By waiting until the market stabilizes, traders reduce the risk of paying hundreds above or below their intended price. BingX’s fast execution helps, but avoiding chaos is still smart risk management.

• Major news can move BTC 1–3% in seconds

• Waiting 10–15 minutes often results in more stable entries

• BingX’s execution engine minimizes slippage even during spikes

5. Break Down Large Orders

Placing a massive order at once can move the market against you, even on liquid pairs. On BingX, traders can break large positions into smaller limit or market orders. This approach reduces price impact while taking advantage of the platform’s deep liquidity across 150+ pairs.

• Large orders = more price impact

• Splitting into smaller trades smooths execution

• Example: 100 BTC market order vs. 10 × 10 BTC orders

6. Trade With BingX’s Infrastructure Advantage

Beyond order types, BingX itself reduces slippage risk with its advanced matching engine, deep liquidity access, and transparent 0.1% trading fees. Combined with Guaranteed Price, BingX positions itself as one of the few exchanges where traders can proactively manage execution risk.

• Advanced tech = faster fills with fewer delays

• Low, transparent fees keep costs predictable

• BingX GTD = zero-slippage execution on Perpetual Futures

Slippage on Decentralized Exchanges vs. BingX

On

decentralized exchanges (DEXs), trades run through liquidity pools rather than order books. This means slippage depends heavily on the depth of the pool: the smaller the pool, the more the price shifts when you place a trade. To manage this, DEXs let users set a slippage tolerance (e.g., 0.5%–1%), which cancels a transaction if the price moves beyond the chosen threshold. While useful, this still leaves room for negative slippage and failed trades if liquidity is thin.

BingX, on the other hand, solves the problem differently. Instead of tolerance ranges, traders get access to limit orders for precise control and the Guaranteed Price feature for Perpetual Futures. GTD ensures execution at your preset price, removing slippage risk entirely, even during flash crashes or sudden surges.

• DEXs utilize liquidity pools, which can lead to a risk of high slippage in low-volume tokens.

• Users set tolerance ranges (0.1%–1%), but trades can fail if prices move too fast.

• BingX replaces tolerance with limit orders + Guaranteed Price (GTD) = exact execution, no tolerance gap.

Conclusion

Slippage is an unavoidable reality in crypto trading—especially on decentralized exchanges, where liquidity pools are thin and trades depend on tolerance settings that still allow price drift or failed transactions. For traders dealing with volatile assets, these gaps can quickly add up to significant costs.

BingX changes the equation. With limit orders, traders already have precision control over their entries and exits. But with the addition of its exclusive Guaranteed Price (GTD) feature for Perpetual Futures, BingX goes further than any tolerance setting on a DEX: it locks execution at your preset price, even during flash crashes or sudden rallies.

This shifts slippage risk from the trader to the platform, giving you confidence that your trades will execute exactly as planned.

Related Articles

FAQ: Slippage in Crypto Trading

1. What is slippage in crypto trading?

Slippage is when your order executes at a different price than expected. On BingX, limit orders and Guaranteed Price (GTD) help eliminate this risk.

2. How do I avoid slippage when buying crypto?

Use limit orders for control, trade in high-liquidity periods, and choose BingX. Its Guaranteed Price ensures execution at your preset price, even in volatile markets.

3. What’s the difference between positive and negative slippage?

Positive slippage gives you a better price than expected, while negative slippage costs you more. BingX tools help protect against negative slippage.

4. Why does slippage happen on DEXs?

DEXs rely on liquidity pools and slippage tolerance settings. Thin pools mean higher risk. BingX avoids this issue with deep liquidity and order-book matching.

5. How Does BingX minimize slippage?

BingX minimizes slippage with fast execution and deep liquidity. Its Guaranteed Price feature for Perpetual Futures locks your trade at the preset price, removing slippage completely.

6. Is BingX better than DEXs for slippage?

Yes. While DEXs use slippage tolerance ranges that still allow price drift, BingX offers precise control with limit orders and Guaranteed Price, giving traders exact execution without risk.