OpenEden (EDEN) is an on chain

RWA platform that brings short dated United States Treasury Bills to crypto rails via its TBILL Vault, while EDEN coordinates governance, incentives, and ecosystem growth.

This guide explains what OpenEden is, how the EDEN airdrop works, the step-by-step claiming process, key dates, and how to trade EDEN on BingX.

What Is OpenEden (EDEN) and How Does It Work?

OpenEden is an on chain RWA platform that brings short dated United States Treasury Bills to crypto rails via its TBILL Vault. Whitelisted wallets deposit

USDC to mint the EIP-20 TBILL token, hold it in self custody, and redeem against the fund’s net assets with instant settlement and audited daily and monthly NAV. The structure is institutional: a regulated BVI fund issues the token, a dedicated investment manager runs a short-duration T-Bill mandate with tier-one custodians, and a separate tech provider maintains the smart contracts without taking deposits.

USDO is OpenEden’s

yield-bearing stablecoin pegged 1:1 to the U.S. dollar. It passes through T-Bill driven yield via a daily rebasing mechanism, while cUSDO is a wrapped, non-rebasing version that accrues the same yield internally for venues that do not support rebasing. Users can move between USDO and cUSDO for payments or integrations, while TBILL remains the tokenized T-Bill exposure and EDEN coordinates governance and incentives. Holders can also stake EDEN to mint xEDEN, a staked receipt token that unlocks program utilities such as governance participation and potential fee perks.

The portfolio targets a weighted-average maturity below three months, giving low-duration exposure to instruments backed by the full faith and credit of the United States. In a market where DeFi yields have compressed and stablecoins often sit idle, OpenEden offers a straightforward, compliant path to on chain T-Bill returns.

OpenEden provides a practical treasury tool for DAOs and institutions holding USDC: mint TBILL in a single transaction, keep self custody, and redeem when needed, all within whitelist rules. EDEN sits on top as the coordination token for governance, incentives, growth programs, and fee discounts, while TBILL remains the tokenized T-Bill exposure.

OpenEden Token Breakdown

1. zTBILL: Tokenized exposure to short-dated U.S. T-Bills, minted with USDC and redeemable at NAV by whitelisted wallets.

2. USDO: Yield-bearing stablecoin pegged to 1:1 USD that distributes T-Bill yield via daily rebasing.

3. cUSDO: Wrapped, non-rebasing USDO that accrues the same yield internally for venues that do not support rebasing.

4. EDEN: Ecosystem token for governance, incentives, growth programs, and potential fee perks.

5. xEDEN: Staked receipt token you get by staking EDEN to unlock program utilities.

What Is the EDEN Token Utility?

• Staking rewards: Earn rewards by locking EDEN in eligible programs.

• Governance: Vote on proposals that shape products, parameters, and roadmap.

• Growth incentives: Participate in campaigns that reward adoption and ecosystem activity.

• Fee discounts: Reduce fees when using OpenEden services where supported.

• Ecosystem coordination: Align users and products across OpenEden; TBILL remains the tokenized T-Bill exposure under whitelist rules.

What Is OpenEden (EDEN) Tokenomics?

OpenEden’s token model uses a capped supply of 1,000,000,000 EDEN. The allocation is built to balance community growth, long term ecosystem funding, contributor incentives, and regulated operations around its real world asset products. Rather than an emissions schedule, the design relies on clearly defined buckets with specific unlocks and vesting. A holder bonus mechanism applies to certain distributions to encourage gradual claiming and reduce short term churn.

EDEN Token Allocation

• Ecosystem & Community: 41.22%: Unlocked at TGE. Budgeted for staking rewards, liquidity incentives, listings support, liquidity provisioning, and other participation programs. This pool also includes a 2,500,000 EDEN contribution to the Bills. Unlocked at TGE: 34.75%.

• Team & Advisors: 20.00%: Minimum 6 month cliff, then linear vesting over 24 months. Reserved for builders and advisors.

• Investors: 15.28%: Minimum 6 month cliff, then linear vesting over 24 months. Reserved for strategic capital partners who helped bootstrap development.

• Foundation: 10.00%: 20% unlocked, remainder subject to cliff and vesting. Intended to support operations, grants, governance aligned initiatives, potential token buyback mechanisms, and future expansion.

• Bills Airdrop: 7.50%: Distributed to Bills Campaign participants. The EDEN Hodler Bonus mechanism applies. Unlocked at TGE: 21.3%.

• Early Adopters: 6.00%: Reserved for contributors since 2023 who drove early adoption and TVL growth. A mechanism similar to the Bills Airdrop applies. Unlocked at TGE: 10%

How Does EDEN Token Differ From TBILL?

Per the source, TBILL is not a conventional utility or governance token with emissions or inflation. It expands and contracts with subscriptions and redemptions and is backed one to one by short dated United States Treasury Bills plus a small cash buffer. Returns to TBILL holders reflect the T Bill portfolio’s yield rather than token issuance. EDEN, by contrast, is the coordination and incentive token for the wider OpenEden ecosystem, with allocations aimed at ecosystem development, community participation, and long term governance aligned programs.

What Is the OpenEden (EDEN) Airdrop?

The OpenEden airdrop rewards early participants who helped seed adoption of on-chain Treasury exposure before broader rollout. Instead of a generic giveaway, OpenEden ran a Bills campaign in which contributors accumulated Bills points through qualifying activity. 7.5% of total supply goes to Bills participants, plus 0.25% in a shared reward pool.

An EDEN Hodler Bonus mechanism rewards later claimants within the allowed window. To check eligibility and claim, use the Foundation’s

official claims page.

Eligibility Criteria for the $EDEN Airdrop

• Your wallet must be whitelisted after KYC or KYB, and transfers follow whitelist rules.

• Who is eligible for the EDEN Airdrop?

- Participants with more than 10,000 Bills points

- Participants with qualified wallets from non-sanctioned countries

- Early adopters of OpenEden have a similar, separate mechanism with their own reward pool.

• No points or phase tasks beyond the above are listed in the provided materials.

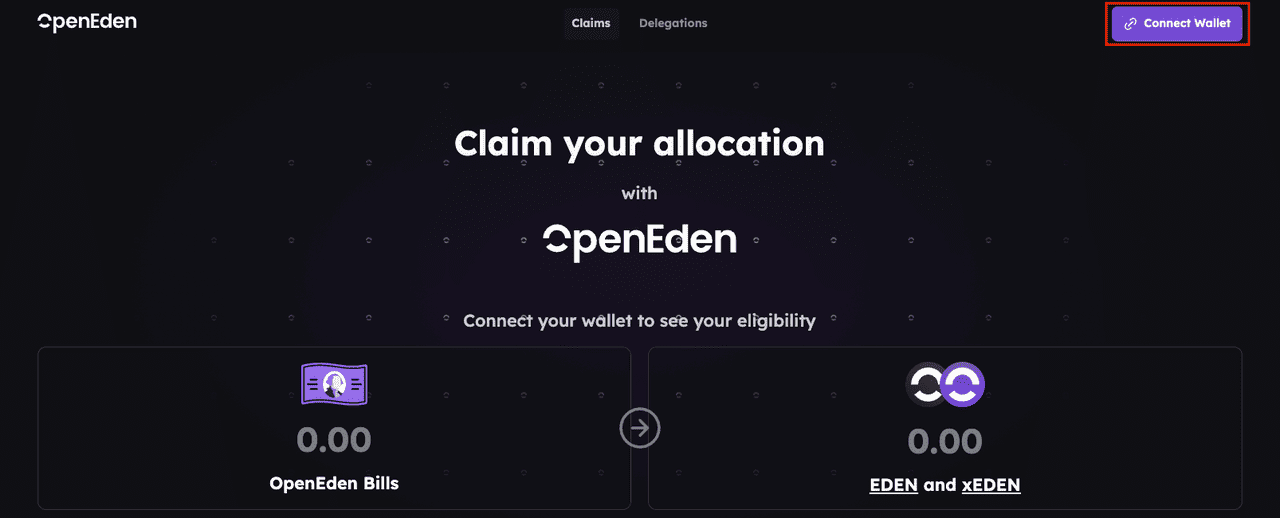

How to Claim EDEN Tokens After Airdrop

How to claim EDEN tokens

If you believe you are eligible, here’s how to claim your EDEN tokens:

1. Wait for claim opening: The airdrop claim went live on September 30, 2025.

2. Open the official claims portal: Use the OpenEden Foundation claims page from official channels only.

3. Connect your wallet: Use the same wallet that you used to onboard for the Bills campaign, and connect via a Web3 wallet such as

MetaMask.

4. Check eligibility: The portal will verify that your wallet is qualified and, if applicable, that you have more than 10,000 Bills points and are from a non-sanctioned country.

5. Submit claim: Review your allocation, accept the terms, click Claim, then approve the transaction in your wallet.

6. Receive EDEN: After confirmation on chain, EDEN will appear in your wallet. If it does not display, add the token contract and refresh.

Note: Only claim through official links. Use a trusted device, confirm the URL, and never share seed phrases or private keys.

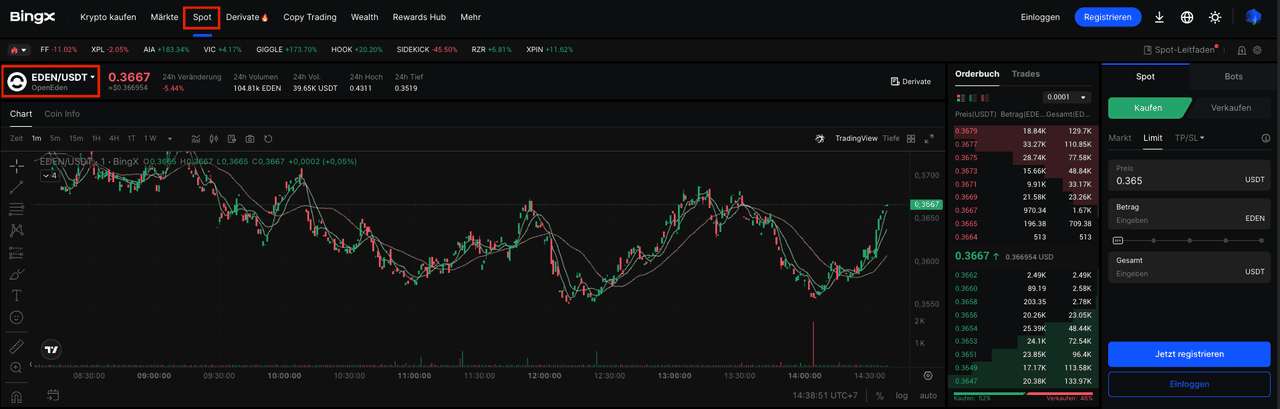

How to Trade OpenEden (EDEN) on BingX After the Airdrop

EDEN/USDT trading pair on the spot market

Once you’ve claimed your OpenEden (EDEN) tokens from the airdrop, you can easily trade them on the BingX

spot market. Spot trading is the simplest way to buy, sell, or hold EDEN without using leverage, making it beginner-friendly.

1. Deposit EDEN to BingX: If your airdropped tokens are in an external wallet, transfer them to your BingX account using the official EDEN deposit address.

2. Search for the EDEN/USDT trading pair: On the BingX spot trading page, type “EDEN” into the search bar and select

EDEN/USDT.

3. Choose an order type

• Market Order: Buy or sell instantly at the current market price.

• Limit Order: Set your own price to buy or sell, giving you more control but requiring patience.

4. Manage risk with BingX AI tools: Use

BingX AI insights to spot support and resistance levels, track whale wallet movements, and analyze liquidity depth before placing trades.

5. Store or trade your tokens: You can hold EDEN long-term on BingX for ecosystem growth potential or actively trade short-term price swings.

Pro tip: Given the volatility that often follows new token launches, consider

dollar-cost averaging (DCA) to reduce entry risk and always use limit orders to avoid slippage.

Risks and Considerations Before Investing in OpenEden

Watch the usual risks: short-term T-Bill values move with interest rates, big redemptions can strain liquidity, and broader U.S. credit or market shocks can hit performance. Smart contracts can fail, and timing your deposits or withdrawals matters. On the ops side, only whitelisted addresses can subscribe or transfer, you’re responsible for self-custody, the issuer won’t cover wallet losses, and you should stick to official links and read the fund terms, including minimums and address rules.

Final Notes

The OpenEden (EDEN) airdrop marks a milestone for the project, giving early Bills campaign participants and qualified early adopters a direct stake in the ecosystem as it scales on chain Treasury access. With allocations tied to Bills points and compliance requirements, the drop rewards those who helped prove demand for a regulated, instant-settlement T-Bill model.

As with any token distribution, proceed carefully. Use only the official claims portal, double check your wallet and network details, and watch for phishing. Remember that eligibility, whitelist rules, and vesting can affect when and how you use EDEN. If you choose to trade on BingX, expect volatility around a new listing and manage slippage and sizing accordingly.

Related Reading