Proof-driven scaling is back in focus as builders look for verifiable throughput and wallet flows that feel native.

Starknet (STRK)'s proposition is clear: execute off-chain, verify on

Ethereum with succinct proofs, and make every account a smart contract to enable features like multisig, session keys, and passkey authentication without protocol changes.

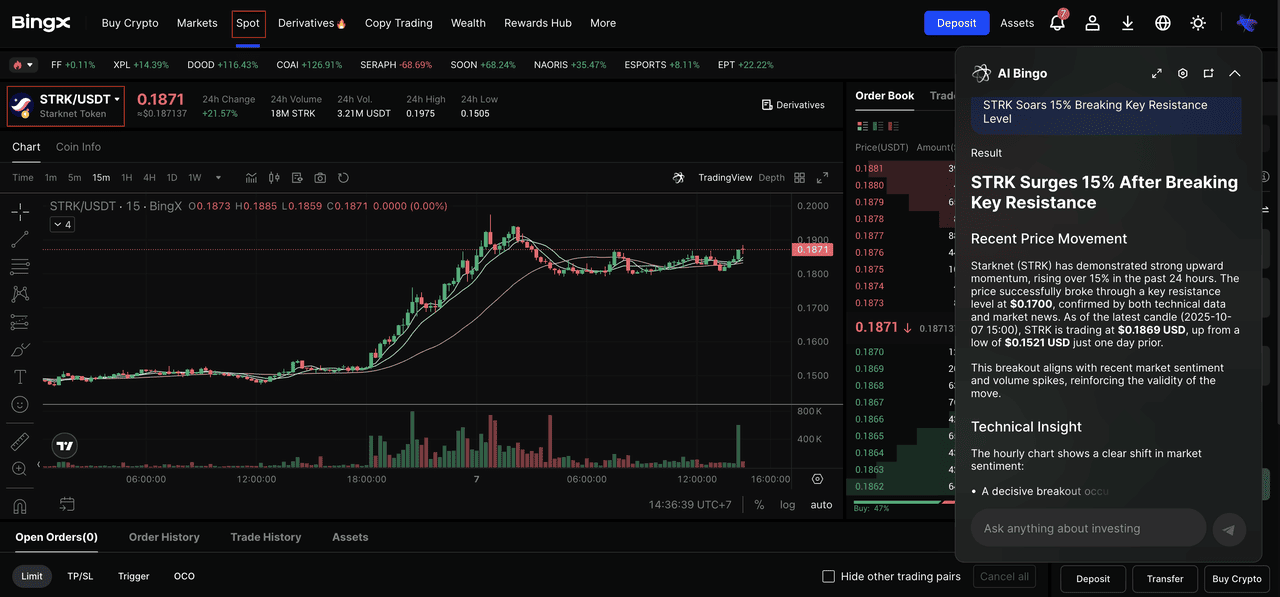

Starknet (STRK) surged over 33% in a week in October 2025 | Source: BingX

Against this backdrop, STRK climbed 25% in 24 hours and over 33% in a week in early October. Fresh BTC-focused incentives, live

Bitcoin staking and yield, and visible interest from professional capital have pulled liquidity and users onto the network, pushing volumes higher.

The result is a cleaner narrative for traders: a validity rollup with programmable accounts, real products shipping, and incentives designed to accelerate adoption.

What Is Starknet (STRK) and How Does It Work?

Starknet is a validity rollup that

scales Ethereum without sacrificing security. Every user is a

smart-contract account, so

wallets can natively enable multisig, session keys, or passkey authentication. Users invoke contract functions, deploy code, or register classes, while L1–L2 messaging links Ethereum and Starknet for secure bridges like StarkGate. Transactions are sequenced into blocks that commit to the post-execution state.

SHARP then aggregates proofs of the SNOS program and submits them to Ethereum, so execution can be trusted without re-running it. Compressed state diffs published on Ethereum ensure data availability and let anyone reconstruct the full state.

Fees for execution, proving, and

Layer 1 publication are payable in STRK or ETH, and staking lets STRK-backed validators secure sequencing and attest to blocks.

The outcome: scalable, expressive applications with low fees and strong Ethereum alignment.

Proof-first L2s are back in focus, and STRK led the move. Here’s what pushed it:

1. BTCFi Season turns on 100M STRK incentives

A

dedicated rewards pool for BTC-collateralized DeFi drew fresh liquidity and users into Starknet, amplifying volumes as programs went live.

Source: Starknet

2. Bitcoin staking and yield launched with early integrations

Live BTC staking and yield plus first-wave products (including Ekubo) gave traders concrete use cases, translating incentives into immediate activity.

3. Institutional interest stepped in

Source: Re7 Captial

4. Macro tailwind from Bitcoin's strength

With Bitcoin trading near fresh all-time highs, Alt/L2 narratives benefited, helping momentum rotate toward STRK.

Put together, targeted incentives, live products, and an institutional bid, set against a supportive Bitcoin backdrop, created a clean catalyst stack for an outsized move. It also implies elevated volatility as programs ramp and new milestones land.

What Is the STRK Token Utility?

Fees & Gas

• Pay transaction fees in STRK or ETH; sequencers convert a portion to ETH to cover L1 gas when needed.

• Supports smoother UX for apps and wallets that want predictable fee flows.

Staking and Network Security

• Stake STRK to help secure the sequencing layer and participate in validator/leader selection for L2 ordering.

• Aims to decentralize control of inclusion/ordering and add economic guarantees before L1 finality.

Governance

• Vote or delegate on protocol upgrades (e.g., Starknet OS changes), parameter updates, and critical maintenance decisions.

• Enables long-term stewardship by aligning active users, builders, and infrastructure providers.

Ecosystem and Community Incentives

• Allocations for grants, community provisions, and potential fee rebates to reduce onboarding costs from Ethereum.

• Funds technology development, rewards contributors, and accelerates app growth.

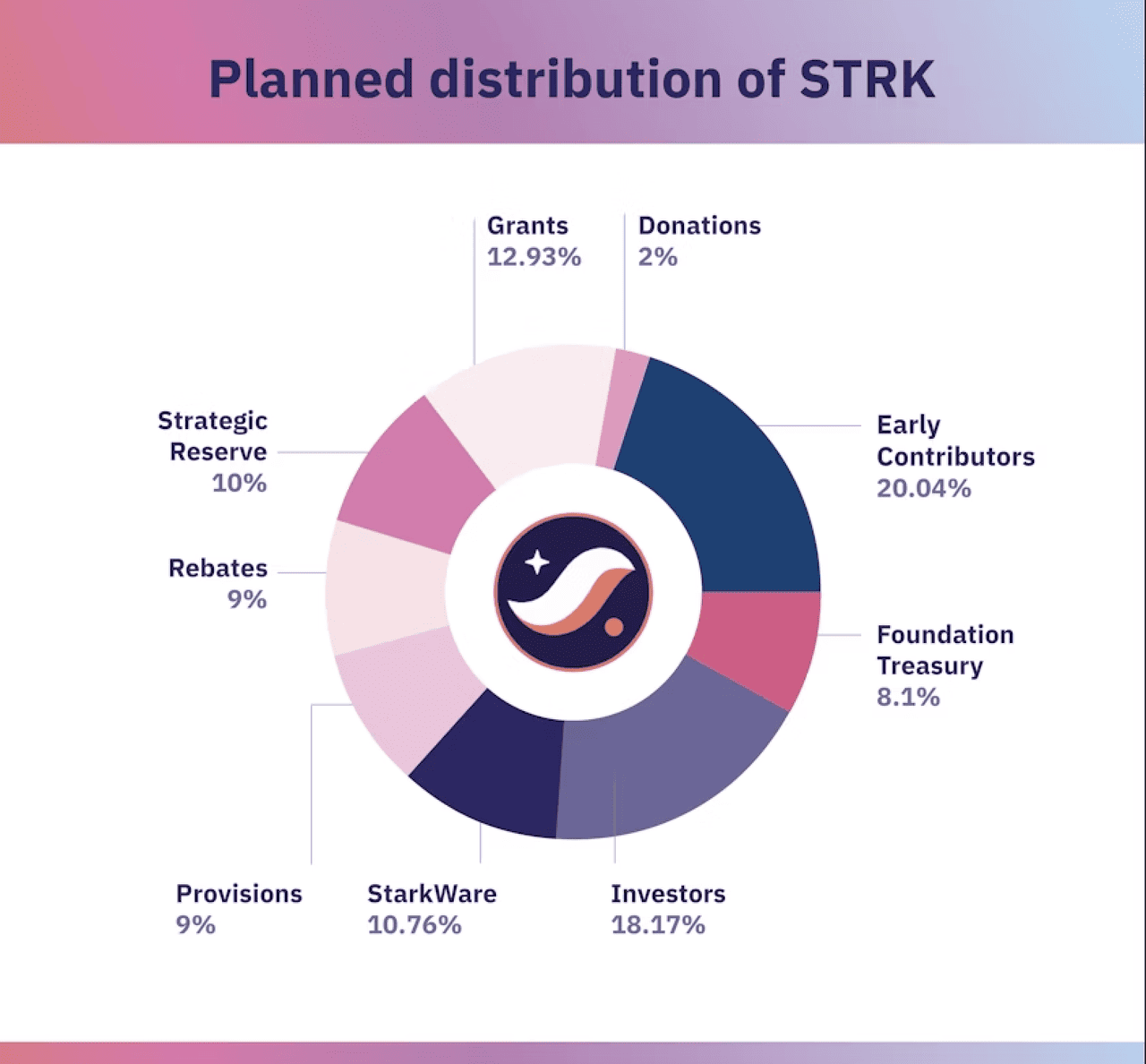

STRK Tokenomics and Token Allocation

10,000,000,000 STRK minted on chain. Distribution is structured to fund core operations, decentralization, and ecosystem growth.

STRK token distribution | Source: Starknet Blog

• Early Contributors: 20.04%: Allocated to StarkWare team members and early contributors. Subject to the lock schedule below.

• Investors: 18.17%: Allocated to StarkWare investors. Subject to the lock schedule below.

• StarkWare Operations: 10.76%: For operational services such as paying fees, providing services on Starknet, and engaging service providers.

• Grants including Development Partners: 12.93%: For research and work to develop, test, deploy, and maintain the Starknet protocol.

• Community Provisions: 9.00%: Distributed to contributors to Starknet and to its underlying technology.

• Community Rebates: 9.00%: Allocated to partially cover onboarding costs from Ethereum. Not yet available and to be announced in a subsequent post.

• Foundation Strategic Reserves: 10.00%: For ecosystem activities aligned with the Starknet Foundation’s mission.

• Foundation Treasury: 8.10%: Treasury available for operations and future initiatives by the Starknet Foundation.

• Donations: 2.00%: Reserved for donations to institutions and organizations as decided by the Starknet Foundation.

Unlock cadence: Investors and Early Contributors unlock up to 0.64% monthly from Apr 15, 2024 to Mar 15, 2025 (7.68% total), then up to 1.27% monthly from Apr 15, 2025 to Mar 15, 2027 (30.48% total). Locked tokens are non-transferable; voting delegation is allowed.

Issuance and inflation: Staking may add supply once a community schedule is set. No block rewards while a single operator runs the sequencer. Effective inflation coefficient is 1.6%.

How to Trade Starknet (STRK) on BingX

Whether you are building a long-term STRK position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token.

With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

STRK/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit STRK or USDT and verify the correct network before trading.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

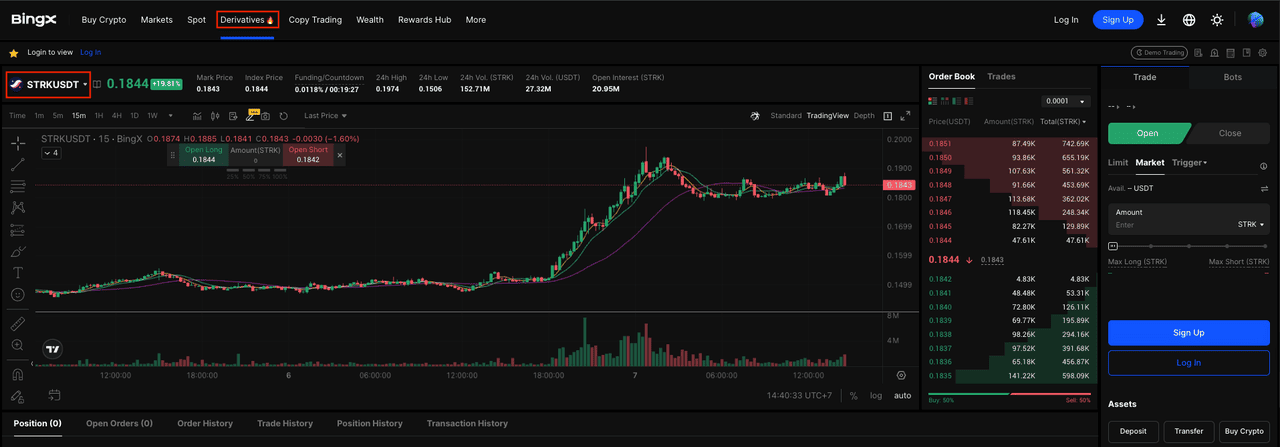

How to Trade STRK Perpetual Futures

STRKUSDT perpetual contract on BingX futures powered by AI Bingo

Futures, especially perpetual futures, let you trade STRK price movements with leverage; you don’t necessarily need to hold the underlying STRK. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

STRK-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate STRK-USDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Conclusion

Starknet’s jump reflects more than hype. Proof-first execution verified on Ethereum, smart-contract accounts, and published state diffs form a clear architecture. With staking moving forward and BTC staking supported via wrappers, the story resonates as products ship and usage grows.

From here, keep it simple: verify any official portals, track unlocks and circulating supply, check market depth and funding, and size positions before the crowd. If staking participation and real activity keep climbing, the utility loop strengthens. If liquidity thins around unlocks, expect sharp reversals. Use official disclosures as your compass.

Related Reading