Agent-based infrastructure has snapped back into focus in 2025 as builders look for verifiable ways to coordinate models, data, and GPU power on-chain. The pitch is simple: let communities co-create automated services, track who contributed value, and route rewards transparently.

Against this backdrop,

ChainOpera AI (COAI) dominated leaderboards with a surge of more than 600% in 24 hours and over 1,220% week over week, lifting its market cap past 526 million USD. The move followed an OrangeX exchange listing and integration into Binance Alpha’s airdrop rewards, which drove trading volume sharply higher in a low-float environment.

What Is ChainOpera AI (COAI) and How Does It Work?

ChainOpera AI is a full-stack platform for collaborative agents that lets users, developers, and resource providers co-create and co-own automated services. It unifies an end-user terminal, a creator platform, and a decentralized marketplace for models, datasets, and GPU power, with a native chain logging contributions so rewards reflect real usage and outcomes.

A terminal-style super app routes instructions to a coordinating “Super Agent,” which orchestrates specialists for multi-step crypto workflows. An Agent Social Network enables shared chats, one-click publishing, and transparent rankings.

For builders, the platform offers templates, APIs, a multi-agent framework, and no-code flows. Over 100,000 creators have launched monetizable agents discoverable in the terminal.

Under the hood, a model-and-GPU layer distributes training and inference across devices and clouds with validation. The Proof of Intelligence protocol records interactions and routes fair rewards across

DeFi,

RWA tokenization, payments, and more.

Source: ChainOpera AI

Why Did ChainOpera AI (COAI) Surge 1,000% in Early October?

Agent platforms are back in the spotlight this week, and COAI led the move. Here is what pushed it:

1. New listings and targeted rewards pulled in liquidity

OrangeX listed COAI and Binance Alpha added an airdrop rewards campaign. The mix of fresh venue exposure and incentives funneled new traders into a thin market, so volume spiked and price followed.

2. A clear story about measurable contributions

ChainOpera AI highlights more than 2 million registered users and over 10,000 agents, plus on-chain tracking that shows who contributed what. That proof-driven message resonated with traders looking for concrete traction, not promises.

3. Positioning ahead of the TGE and future unlocks

Markets are watching the Token Generation Event and upcoming claim windows. Anticipation can pull order flow forward when circulating supply is still tight, which magnifies moves in both directions.

Put together, venue exposure, incentive design, and a contribution-first narrative created the perfect setup for an outsized rally. It also means volatility can stay elevated as milestones approach.

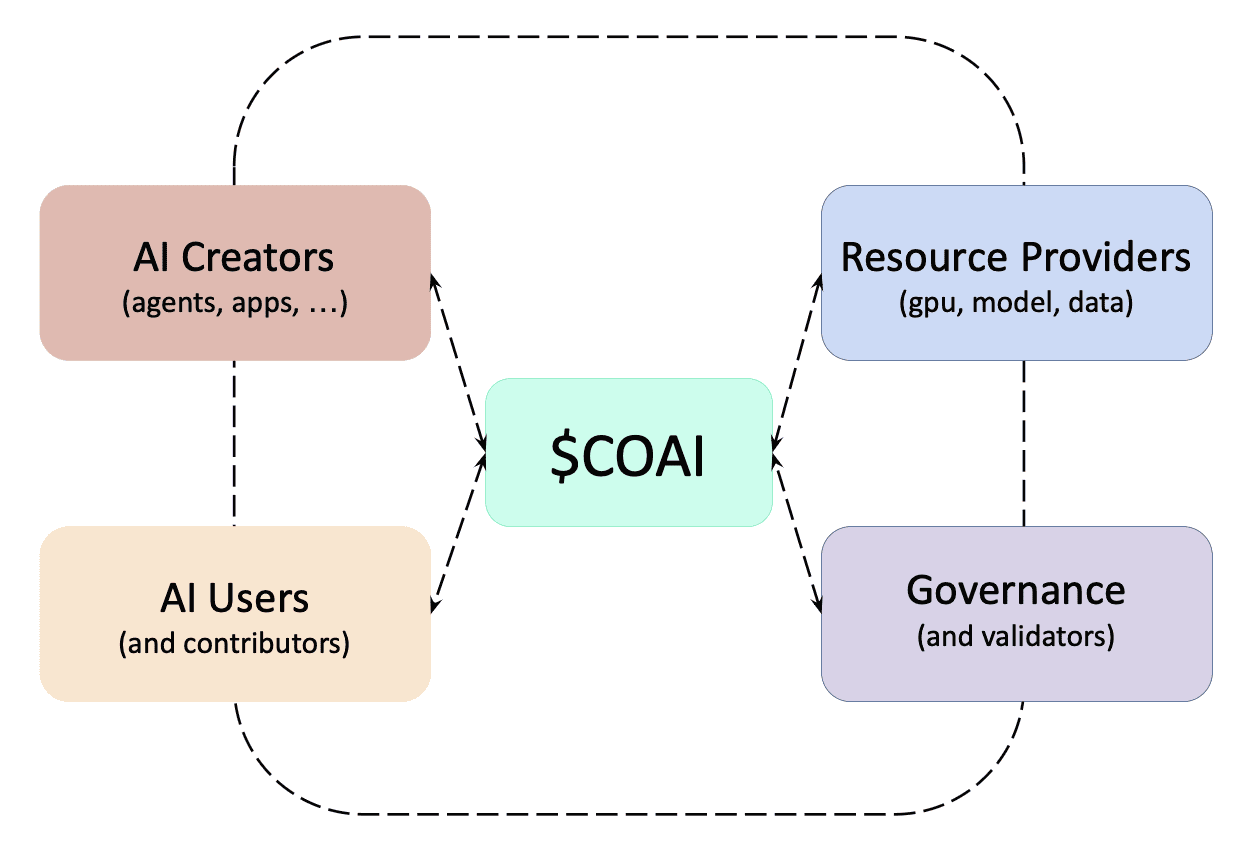

What Is the COAI Token Utility?

• Users and contributors: Spend COAI to unlock premium features in the Terminal and Agent Social Network; earn recognition for feedback or non-personal data; build verifiable reputation on-chain.

• App & agent creators: Use COAI for developer tools and publishing; gain usage-based recognition and visibility; follow transparent quality standards and reputation metrics.

• Resource providers (GPU, models, data, annotators): Use COAI to register and make resources discoverable; accrue contribution credits; surface reliability via performance stats and verifiable usage records.

• Governance participants: Hold COAI to join discussions, propose upgrades, and help set open-source standards and ecosystem guidelines focused on long-term transparency and growth.

Source: ChainOpera AI

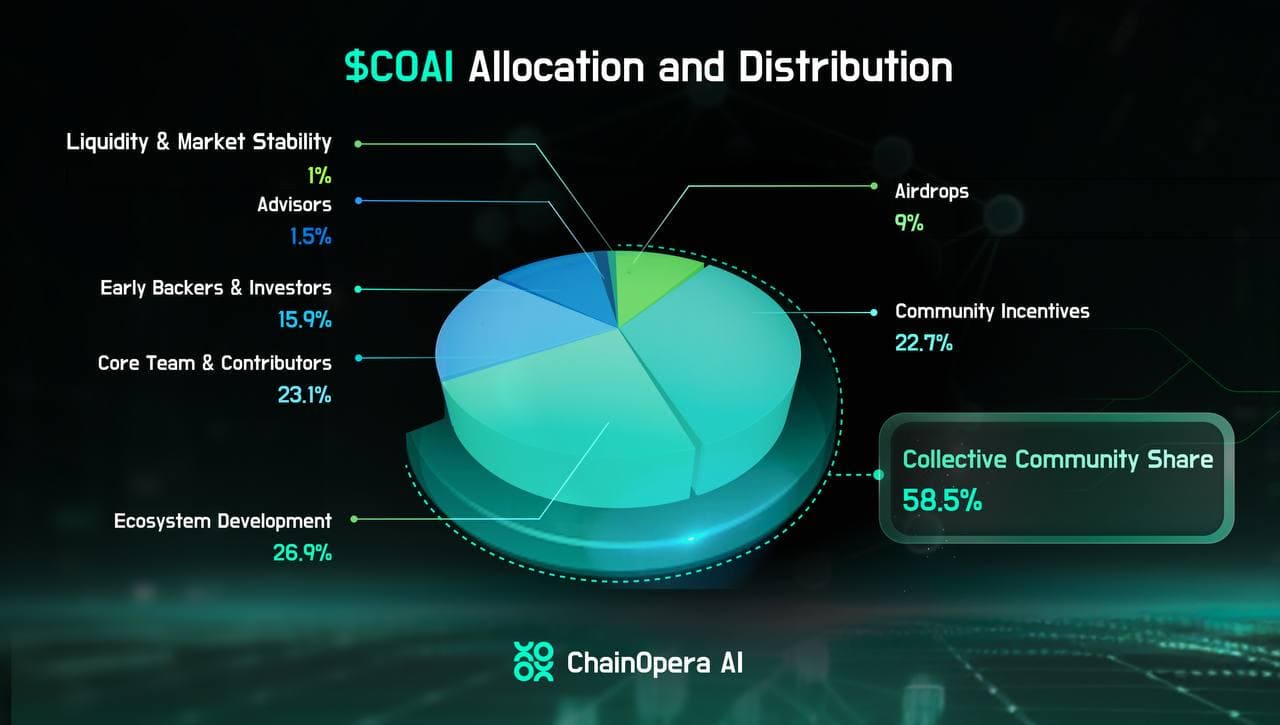

COAI Tokenomics and Token Allocation

The total supply is fixed at 1,000,000,000 COAI. Distribution is structured to prioritize broad participation and long-term alignment.

COAI token distribution | Source: ChainOpera AI Blog

• Collective Community Share: 58.5%

- Ecosystem Development: 26.9% for builder programs, infrastructure contributions, hackathons, and upgrades to the terminal, agent network, and developer platform.

- Community Incentives: 22.7% for creators, resource providers, and user engagement programs, including ambassadors and regional initiatives.

- Early Distribution and Airdrops: 9% allocated to early contributors through targeted campaigns: 1.5% ChainOpera community airdrop (first batch), 3% Binance Alpha airdrop, and 4.5% for future airdrops.

• Core Team and Contributors: 23.1% with a 1-year lock and 36 months of linear monthly releases.

• Advisors: 1.5% with the same 1-year lock and 36-month linear release.

• Early Backers and Investors: 15.9% for strategic partners that helped move research into production.

• Liquidity and Market Stability: 1%.

Initial availability at TGE is about 19.65%, covering ecosystem development (5.45%), airdrops (9%), community incentives (4.2%), and liquidity (1%). Core team, backers, investors, and advisors are fully locked at TGE. Circulating supply is designed to reach roughly 25% by the end of year one and fully unlock by month 48.

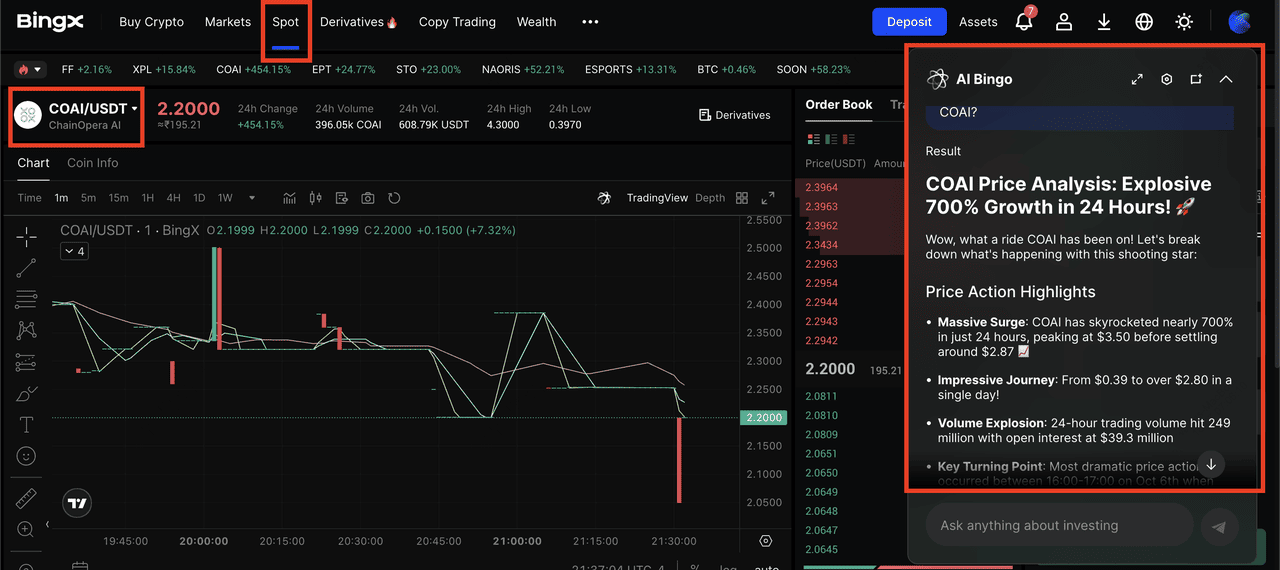

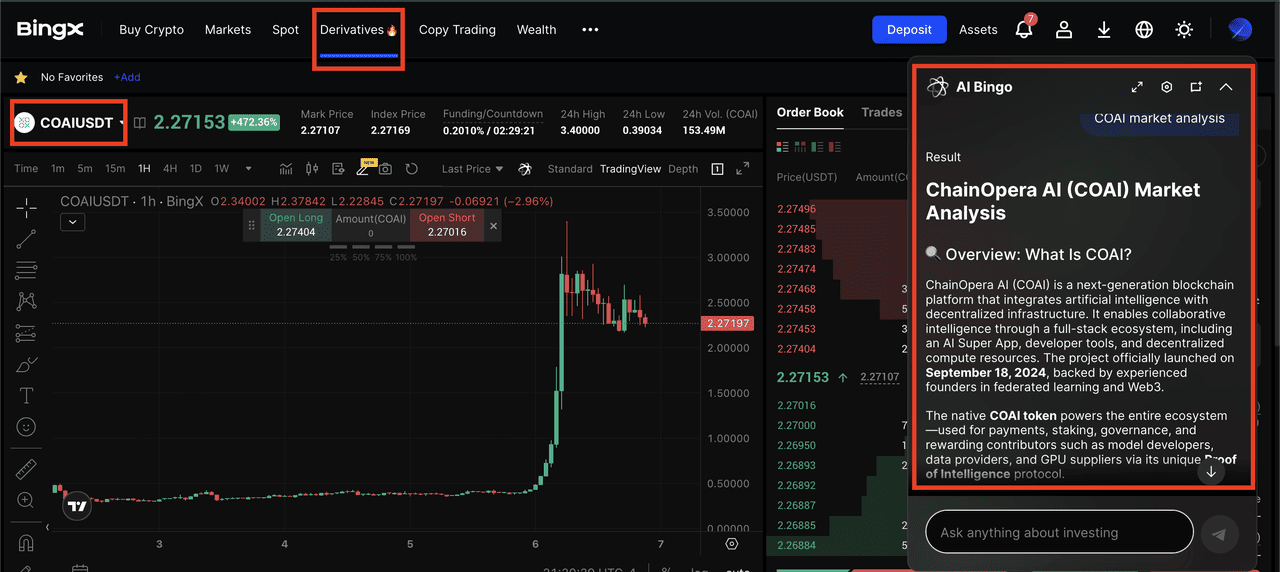

How to Trade ChainOpera AI (COAI) on BingX

Whether you are building a long-term COAI position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token. With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

COAI/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit COAI or USDT and verify the correct network before trading.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

How to Trade COAI Perpetual Futures

COAI/USDT perpetual contract on BingX futures powered by AI Bingo

Futures, especially perpetual futures, let you trade COAI price movements with leverage; you don’t necessarily need to hold the underlying COAI. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

COAI-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate COAI-USDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Conclusion

COAI’s spike reflects more than hype. ChainOpera AI links usage and contribution quality to on-chain records and pays for what proves useful, a design that resonated once listings and rewards pulled in fresh liquidity. From here, keep it simple: verify claim portals, track unlocks and circulating supply, check market depth and funding, and size positions before the crowd.

If agent adoption and real activity keep climbing, the utility loop strengthens. If liquidity thins around unlocks, expect sharp reversals. Use official disclosures as your compass.

Related Reading