GOAT Network is a

Bitcoin-native ZK Rollup that scales throughput, pays gas in

BTC, and shares fees with stakers and decentralized sequencers while rewarding proof verifiers and builders.

This quick guide explains what GOAT Network is, how GOATED fits into the design, where the yield comes from, and the practical steps to start using the network.

What Is GOAT Network (GOATED) and How It Works?

GOAT Network is described in the source as a Bitcoin-native ZK Rollup: transactions are processed off chain, bundled, proven with zero-knowledge proofs, and then anchored back to Bitcoin. A challenge framework referred to as BitVM2 underpins verification so disputes can be resolved while users keep control of funds. On GOAT Network, gas is paid in BTC, which ties activity directly to the Bitcoin economy rather than to a separate gas token.

The product stack centers on three pillars: trading,

yield, and play. A native bridge brings assets onto the chain, with options to bridge BTC or supported assets such as BTCB and DOGEB via the project’s bridge, and

USDT,

USDC, or WETH through a partner bridge. Once on chain, users can swap on the network’s Uniswap v3 deployment and other

DEXs, provide liquidity, borrow and lend, or stake. The “play” pillar adds BTC-denominated games that settle in BTC. The goal is to keep flows in native BTC while enabling use cases that Bitcoin’s base script does not handle well.

GOATED coordinates the system. It serves as both governance and reward mechanism. Staking or locking GOATED can boost

BTC yield, and stakers have a higher chance to be selected as sequencers who earn BTC transaction fees. Rewards in GOATED also accrue to roles involved in

zk proof verification and to builders who ship applications on GOAT Network. The network emphasizes decentralized sequencers so control and revenue are spread across independent operators instead of one central entity.

GOATED Token Utility

• BTC-denominated yield boost: Stake or lock GOATED to enhance BTC rewards that come from on-chain activity where gas is paid in BTC.

• Sequencer incentives: Stakers increase their chance to be selected as decentralized sequencers and can earn BTC transaction fees.

• Governance rights: Propose and vote on network parameters and on-chain treasury usage.

• Ecosystem rewards: Mining pool allocations pay roles like zk proof verification and incentivize builders and users across dApps (liquidity, staking, farming, borrow-lend).

• Airdrop and community programs: Dedicated pools drive adoption via snapshot-based airdrops and ongoing participation incentives.

• Fee alignment: Although fees are in BTC, GOATED coordinates behavior by boosting yields for stakers and directing incentives to the actors that keep the rollup running.

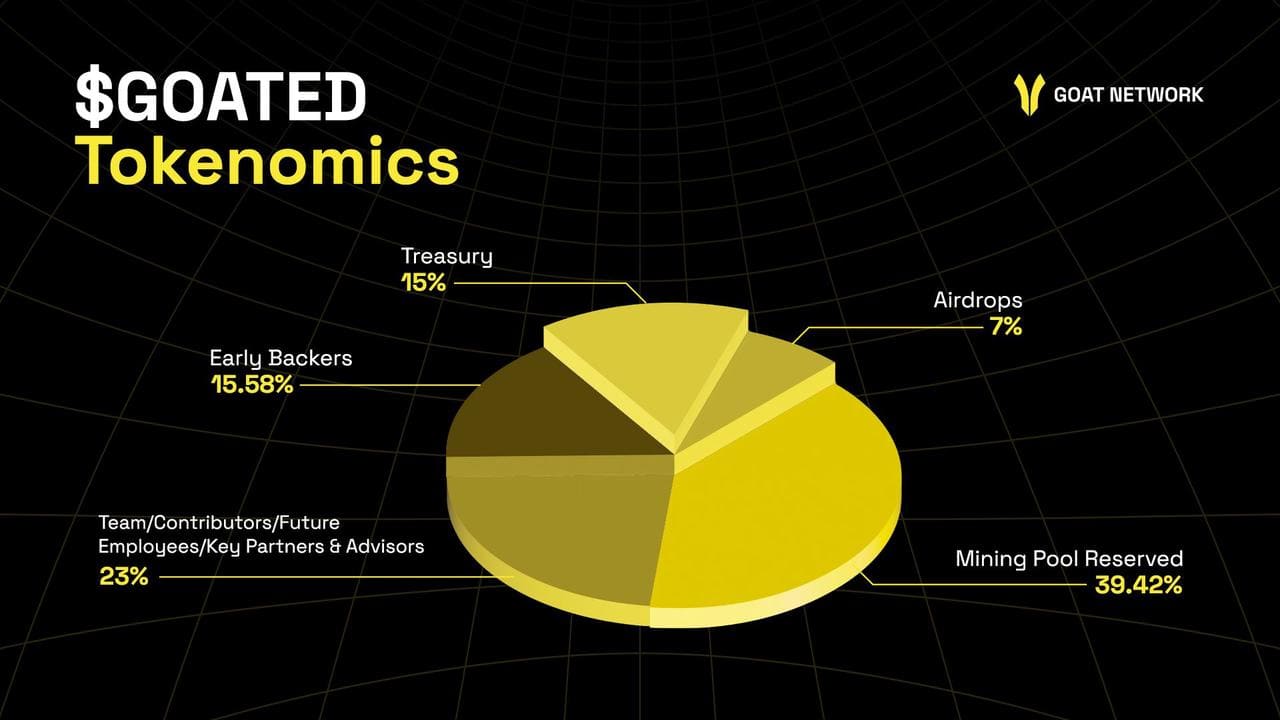

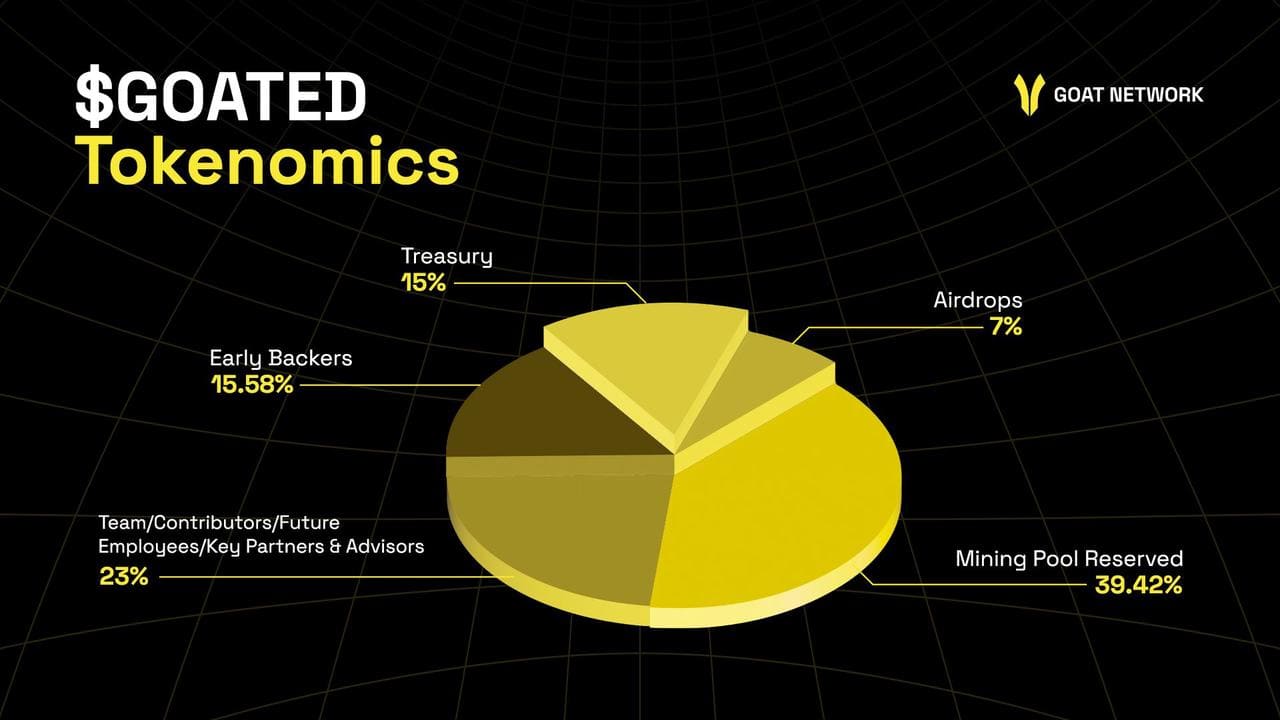

GOATED Tokenomics and Allocation

At launch, GOAT Network specifies a fixed 1,000,000,000 GOATED lifetime supply, with the largest share directed to network operation and growth through an ecosystem mining pool. The allocation emphasizes decentralized sequencing, proof verification, and builder incentives while staging team and supporter holdings through cliffs and linear vesting to align long term participation.

GOATED token distribution | Source: GOAT Network

GOATED Token Allocation

• Ecosystem Mining Pool (39,42%): Funds decentralized sequencer participation, zk proof verification, and contributor rewards.

• Team, Contributors, Partners, Advisors (23%): Subject to a 12-month cliff followed by 18 months of linear vesting.

• Early Supporters (15.58%): Distributed with a cliff and subsequent vesting period.

• On-chain Treasury (15%): For initiatives such as liquidity provision and ecosystem incentives.

• Airdrops (7%): Snapshot-based distribution to encourage user participation.

TGE unlock: 10.43% of total supply becomes transferable at the token generation event.

What Is the GOAT Network Airdrop?

GOAT Network is airdropping GOATED to eligible Yappers and on-chain users based on snapshots, with claims made through the official portal and BTC as gas. Beyond a tradable balance, recipients can stake or lock GOATED to boost BTC-denominated yield and participate in governance. If you lack BTC on GOAT Network, you can bridge supported assets and swap to BTC on the network’s DEX before claiming. The ongoing One Piece rewards program runs alongside the airdrop but remains separate unless stated otherwise by the project.

Eligibility

• Community Airdrop: Targets users who engaged with GOAT ecosystem activities, including One Piece on-chain and social tasks. Eligibility follows official settlement data; if your address appears on the Artemis list, claim directly at artemisfinance.io. Claims open September 27, 10:00 UTC and remain available for 90 days; any unclaimed tokens revert to the GOAT Treasury and are not reissued.

• Kaito Airdrop (Yappers and Kaito users/stakers): Yappers must bind an X account for verification. Kaito users and stakers must hold 5,000+ sKAITO or YT-sKAITO with a 7-day time-weighted average above 5,000 (snapshot September 17, 2025). Claims also start September 27, 10:00 UTC and run for 90 days, after which unclaimed tokens return to the Treasury.

How to Claim $GOATED Airdrop

If you believe you are eligible, here’s how to claim your GOATED tokens:

1. Wait for claim opening: The airdrop claim goes live on September 27, 2025 at 10:00 UTC.

2. Access the official GOAT Network claim portal: Use the project’s verified links to open the claim page and double check the URL.

3. Connect your wallet: Use a

Web3 wallet, e.g.,

MetaMask, and the same address tied to your GOAT activity. Ensure your network is set to GOAT and you have a small BTC balance for gas.

4. Verify eligibility: The portal checks your address against snapshot data and shows any claimable GOATED. If your address is on the Artemis list, you’ll be directed to claim at artemisfinance.io.

5. Submit claim: Review your allocation, accept the terms, click Claim, then approve the BTC-gas transaction in your wallet.

6. Receive GOATED: After on-chain confirmation, GOATED appears in your wallet. If it doesn’t, add the token contract manually and refresh.

Note: Claims require BTC for gas on GOAT Network. If you lack BTC, bridge supported assets to GOAT and swap into BTC before claiming.

How to Trade GOATED on BingX After Claiming

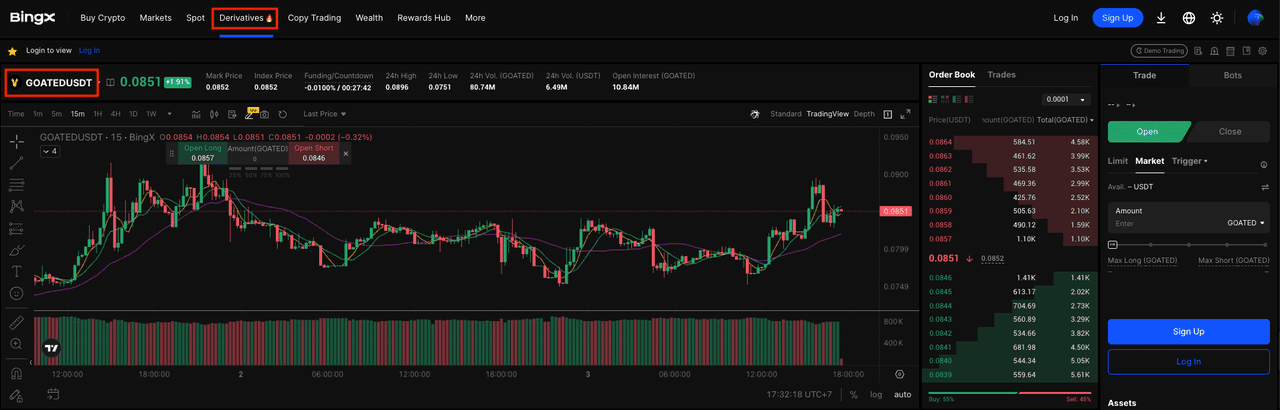

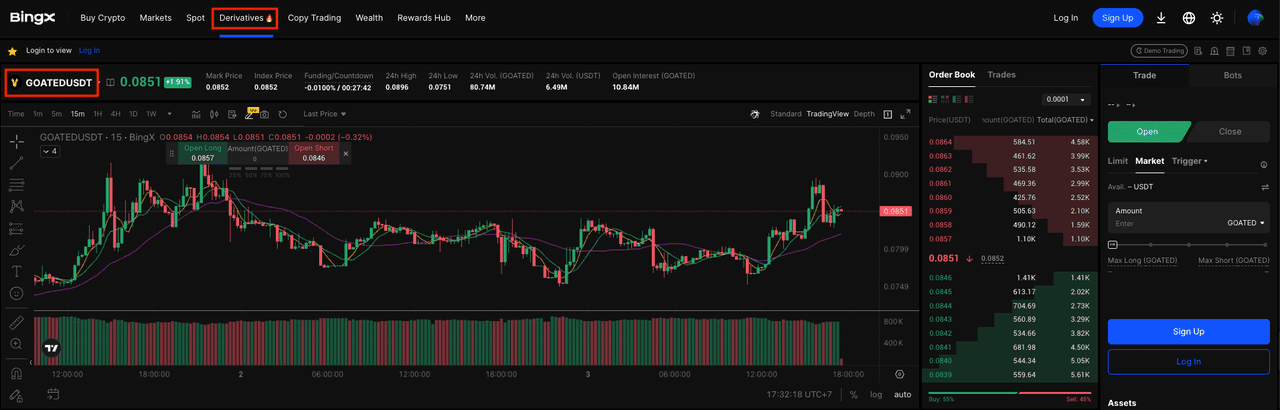

GOATED/USDT trading pair on the futures market

Once you’ve claimed your tokens, you can speculate or hedge on

BingX Futures using the

GOATED/USDT perpetual contract. Futures let you go long or short with leverage; there is no BingX spot pair for GOATED at this time.

1. Deposit USDT to Futures: Move USDT into your USDⓢ-M Futures wallet on BingX. This serves as margin for the GOATED/USDT contract.

2. Find the GOATED/USDT contract: In Futures, type “GOATED/USDT” in the search bar and open the contract page to view leverage limits, funding schedule, and specs.

3. Choose an order type and leverage

• Limit Order: Set your own price and wait to be filled.

Select Isolated or Cross margin, set leverage and size, then place Long (Buy) if you expect price to rise or Short (Sell) if you expect it to fall.

4. Manage risk and positions: Set

Stop Loss and Take Profit after entry, monitor funding rates, maintenance margin, and unrealized PnL. Close via Market for speed or Limit for price control.

Pro tip: New listings can be volatile. Start with low leverage, use Isolated margin, and place limit orders to reduce slippage and liquidation risk.

Key Considerations Before Claiming GOAT Network (GOATED) Airdrop

Claims and token launches involve operational and market risk. Eligibility can change between snapshot and claim; always verify status on official channels. Claims require BTC for gas on GOAT Network. When bridging BTC into the network using the Receive feature, the documentation notes a minimum credited amount of 0.0002 BTC. Deposits below that threshold may be lost and cannot be recovered. If you bridge other assets, follow the steps in the bridge guide and swap to BTC on the network’s DEX before claiming.

On token mechanics, only 10.43% of supply unlocks at TGE. The rest is subject to cliffs and linear vesting for teams and early supporters. Unlock events can affect liquidity. Staking APR examples in the source are illustrative and vary with usage; they are not fixed guarantees. Finally, phishing attempts increase around airdrops.

Do not click on unverified links. Never share your seed phrases. Token contracts should be added manually from the official website when needed.

Final Notes

Everything above is drawn from the supplied source materials. If you plan to claim or stake, start at the

documentation site, verify the claim portal URL, and keep a small BTC balance on GOAT Network for gas.

Review bridge minimums, vesting schedules, and network settings before moving assets. If you intend to trade, confirm tickers and supported networks on the venue you choose. For any detail not present in the source, rely on official announcements rather than third-party summaries.

Related Reading