Amazon has become one of the most traded tokenized equities in 2025, with

Ondo’s Amazon Tokenized Stock (AMZNON) attracting 552 holders, $3.19 million in total on-chain asset value, and an explosive +1,826% surge in monthly transfer volume. As global demand grows for 24/7 access to blue-chip U.S. stocks, AMZNON brings Amazon’s trillion-dollar growth story on-chain, letting you trade economic exposure to AMZN anytime, anywhere, directly with

USDT on BingX. Whether you're betting on AWS expansion, e-commerce dominance, or the rise of

tokenized real-world assets, AMZNON gives you a seamless way to capture Amazon’s momentum through blockchain-powered markets.

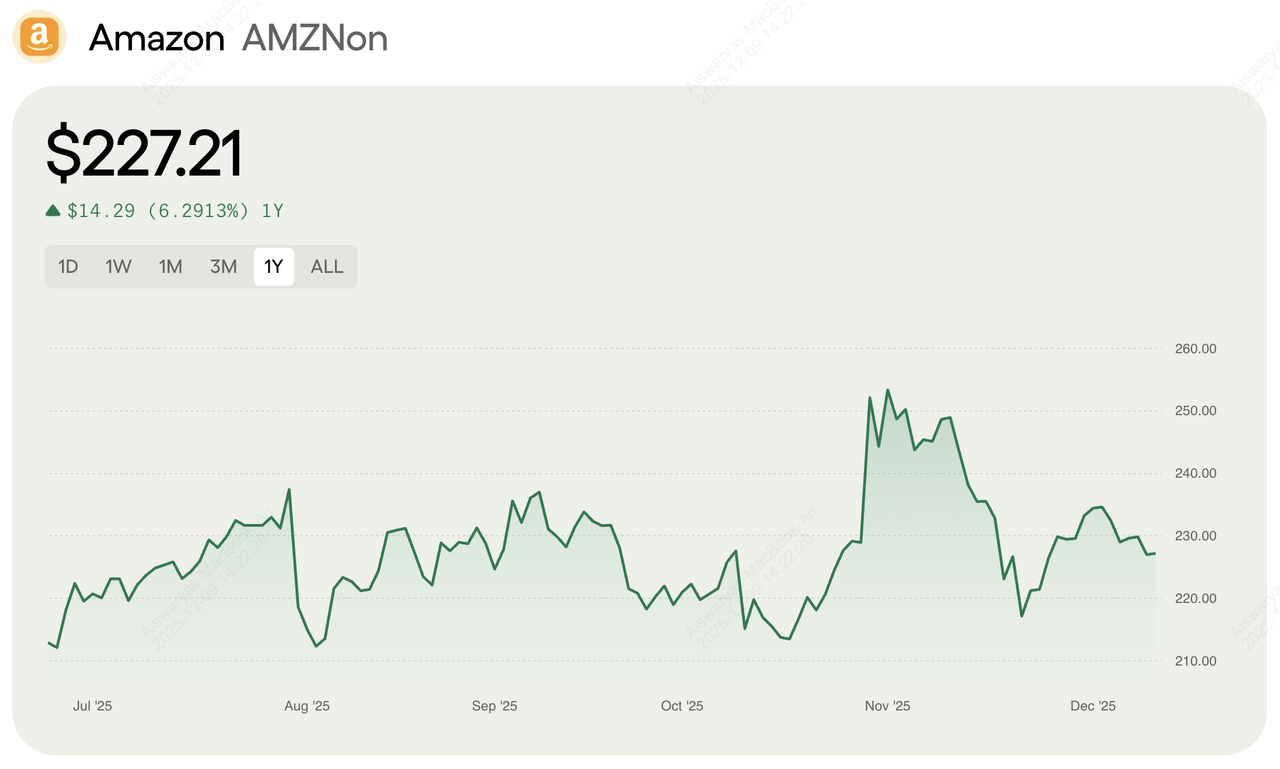

AMZNON price performance | Source: Ondo Global Markets app

What Is Amazon Ondo Tokenized Stock (AMZNON)?

Amazon Ondo Tokenized Stock (ticker: AMZNON) is a blockchain-based, total-return representation of Amazon’s common stock issued by

Ondo Global Markets. Each AMZNON token is fully backed 1:1 by underlying Amazon (AMZN) shares held with U.S.-registered custodial broker-dealers through Ondo’s regulated infrastructure.

One AMZNON token = 1 AMZN share in economic exposure.

AMZNON tracks the total return of Amazon stock, meaning any dividends at the issuer level are automatically reflected in the token’s Net Asset Value (NAV), without granting traditional shareholder rights such as voting.

Instead of opening a U.S. brokerage account, eligible non-U.S. users can buy AMZNON directly on public blockchains and exchanges. BingX lists AMZNON, allowing anyone outside the U.S. to trade Amazon exposure using USDT, 24/5, with the flexibility of crypto-style settlement, fractional units, and seamless portfolio allocation.

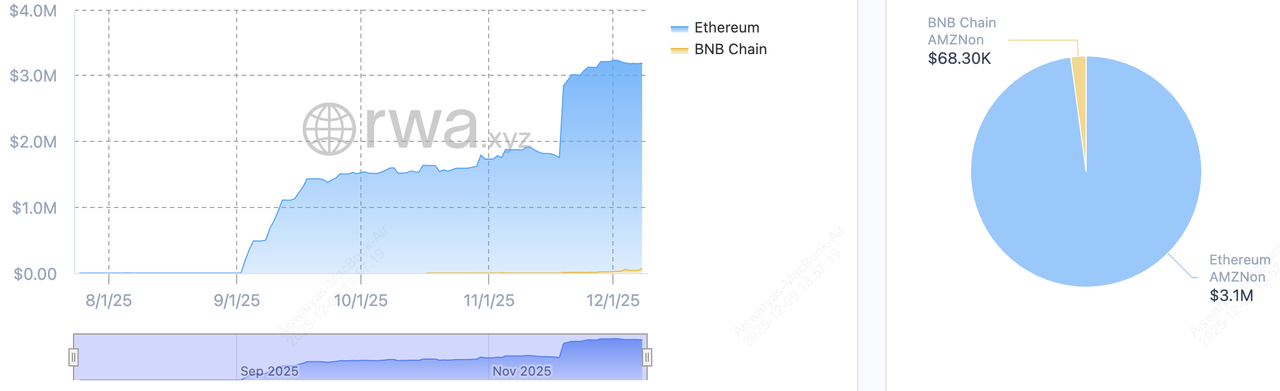

AMZNON tokenized share total value and market cap breakdown by blockchain | Source: RWA.xyz

As of December 2025, AMZNON has gained significant traction across

Ethereum and

BNB Chain, with $3.19 million in total on-chain asset value, a NAV of $227, and a circulating supply of 14,046.95 tokens. The holder base has grown to 552 wallets, rising 17.20% in the past month, while monthly transfer volume surged to $30.76 million, up an impressive 1,826%. Most activity sits on Ethereum, which hosts roughly 13,746 tokens, compared to about 301 tokens on BNB Chain, reflecting strong multi-chain adoption and growing demand for tokenized Amazon exposure.

How Does Ondo’s Amazon Tokenized Stock (AMZNON) Work?

AMZNON follows the same tokenized equity architecture used across the Ondo Global Markets suite:

1. Backing and Custody

Ondo Finance’s entities purchase and custody real Amazon shares with regulated U.S. broker-dealers such as Alpaca Securities. A third-party Security Agent holds a perfected, first-priority security interest over the collateral, ensuring tokenholder protection.

Note: AMZNON holders do not own legal AMZN shares, but they receive economic exposure equivalent to holding Amazon stock with reinvested dividends, minus applicable fees or taxes.

2. Minting and Redemption

Eligible non-U.S. investors can:

• Mint AMZNON by sending

USDC or supported assets to Ondo’s primary market.

• Redeem AMZNON back into

stablecoins or cash at NAV, with order routing to traditional U.S. equity liquidity.

Minting and redemptions operate 24 hours a day, five days a week, ensuring tight alignment between AMZNON and AMZN prices.

3. Price Tracking and Liquidity

AMZNON’s price stays closely aligned with Amazon’s real-world stock value through real-time AMZN pricing feeds, Ondo’s RFQ system, and active liquidity providers. Arbitrage between mint/redeem NAV and on-chain markets further helps keep prices in line, supported by growing liquidity across BingX, Ethereum, and BNB Chain. This integrated mechanism reduces the large premiums or discounts that earlier

tokenized stock models often experienced.

How Does AMZNON Tokenized Stock Differ From Regular Amazon Stock (AMZN)?

AMZNON mirrors Amazon’s price movementsm earnings reactions, macro sentiment, retail sales trends, AWS developmentsm but it is not the same as holding traditional AMZN shares.

Here are the key differences:

1. No Shareholder Rights: AMZNON does not provide voting rights, direct dividends, or shareholder communications. Instead, all economic value, including dividend effects, flows into the token’s NAV.

2. On-Chain Flexibility: You can send AMZNON between wallets, trade it 24/5 on BingX, buy fractional amounts, or use it in supported DeFi protocols. This mobility is not possible with traditional AMZN shares.

3. Eligibility and Jurisdiction: Because AMZNON is issued under a Reg S exemption, it is not available to U.S. persons. Eligible non-U.S. users can access Amazon exposure without opening a U.S. brokerage account.

4. Settlement: AMZNON settles like crypto, using USDT with near-instant execution and no T+2 clearing delays common in traditional equities.

How to Buy Amazon Ondo Tokenized Stock (AMZNON) on BingX

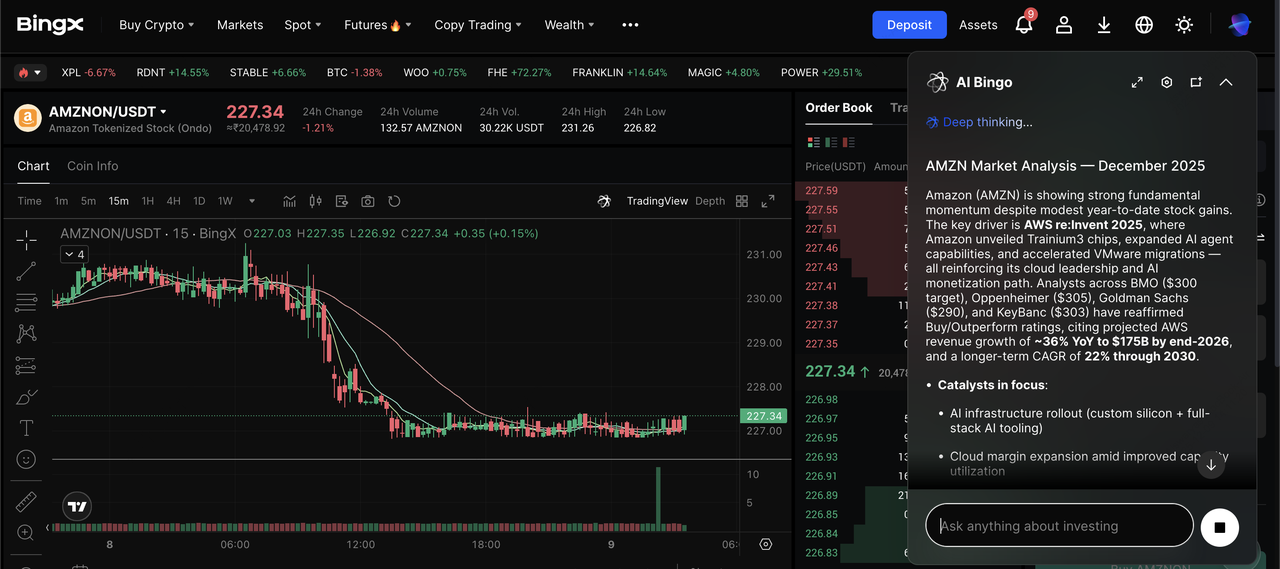

AMZNON/USDT trading pair on the spot market powered by BingX AI insights

Amazon tokenized stock AMZNON/USDT is available for spot trading on BingX, combining Amazon stock exposure with crypto-style execution and real-time market insights powered by

BingX AI.

Step 1: Create or Log In to Your BingX Account

Sign up at BingX.com or open the BingX app. Complete identity verification (

KYC) if required in your region.

Step 2: Deposit USDT

Deposit USDT into your BingX Spot Wallet using bank transfer, card payments,

P2P trading, or a

crypto deposit from an external wallet. Once the funds arrive in your Spot Wallet, you’re ready to trade.

Step 3: Search for AMZNON/USDT

Open

Spot Trading, search “AMZNON,” and select

AMZNON/USDT. BingX also provides AI-powered insights to help you assess volatility, price patterns, and market trends.

Step 4: Place a Buy Order

Choose between a

Market Order to buy instantly at the best available price or a Limit Order to set your preferred entry price. Once submitted, the order executes according to current market conditions. Enter the amount, click Buy, and your AMZNON tokens will appear in your Spot wallet.

Step 5: Manage Your Position

You can manage your AMZNON position by selling anytime, setting price alerts, and using TP/SL (

take-profit, stop-loss) tools for risk control. BingX AI also helps you track historical performance, volatility, and key Amazon-related market trends.

How to Store and Use AMZNON Tokenized Shares Safely

Storing AMZNON on BingX is the most convenient choice for active traders, giving you instant trading access, zero gas fees, and seamless conversions back to USDT. With built-in price tools and portfolio tracking, it’s ideal for users who prefer simplicity and don’t want the responsibility of managing private keys.

If you prefer full control, you can withdraw AMZNON to

self-custody wallets like

MetaMask,

Ledger,

Trust Wallet, or any ERC-20/BEP-20 compatible wallet. This offers greater privacy and potential DeFi usage but requires careful seed-phrase security, correct network handling, and awareness of smart contract and liquidity risks.

What Are the Pros and Cons of Buying Amazon Ondo Tokenized Stock (AMZNON)?

Pros

1. Global Access Without a U.S. Brokerage – Non-U.S. investors can gain Amazon exposure without opening a U.S. brokerage account.

2. 24/5 Trading – You can trade AMZNON even when NASDAQ is closed, offering greater flexibility.

3. Fractional Units – AMZNON allows you to buy any amount, making Amazon exposure accessible even with small budgets.

4. Fully Backed and Transparent – The token is supported by verified custodial holdings, daily attestations, and a bankruptcy-remote legal structure.

5. DeFi Compatibility – AMZNON can be used in certain liquidity pools, structured products, or lending markets where supported.

6. Integrates Easily With Crypto Portfolios – It fits seamlessly alongside

BTC,

ETH, stablecoins, and other crypto assets for diversified allocation.

Cons

1. No Shareholder Rights – AMZNON holders do not receive direct dividends, voting rights, or traditional shareholder privileges.

2. Regulatory Uncertainty – Tokenized stocks face evolving regulations that may affect availability or trading conditions.

3. Custody and Issuer Risk – Users rely on Ondo’s custodial and issuance infrastructure despite existing security protections.

4. Liquidity Variability – Liquidity is improving but still far lower than Amazon’s trading activity on NASDAQ.

5. Limited Jurisdictional Availability – AMZNON is restricted from use by U.S. persons and residents in certain jurisdictions.

Is Amazon Ondo Tokenized Stock (AMZNON) a Good Investment?

AMZNON provides flexible, global access to Amazon’s long-term growth story, including e-commerce dominance, AWS cloud expansion, advertising, logistics, and AI services, combined with blockchain-native benefits like fractional ownership, rapid settlement, and 24/5 trading on BingX.

While AMZNON is fully backed by underlying Amazon shares, it does not replace traditional AMZN stock due to the absence of shareholder rights and additional issuer, market structure, and regulatory risks. You should treat AMZNON as a speculative, RWA-style investment blending equity exposure with crypto mechanics, suitable for diversified, risk-aware portfolios.

Related Reading

FAQs on Amazon Ondo Tokenized Stock (AMZNON)

1. Is AMZNON backed by real Amazon shares?

Yes, each AMZNON tokenized share is fully backed by Amazon (AMZN) shares held by regulated custodial broker-dealers and monitored through daily attestations.

2. Do I get dividends or voting rights if I own AMZNON tokenized stocks?

No. AMZNON provides total-return economic exposure but does not grant traditional shareholder rights.

3. Which blockchains support AMZNON tokenized shares?

As of December 2025, AMZNON is currently live on Ethereum as an ERC-20 token and on BNB Chain as a BEP-20 token. Support for

Solana and Ondo Chain is planned for upcoming releases, expanding its multi-chain availability.

4. Where can I buy AMZNON?

You can buy AMZNON directly on BingX, recommended for liquidity and ease of use, as well as on decentralized platforms like Uniswap and select centralized exchanges that support tokenized equities.

5. Can AMZNON be used in DeFi?

AMZNON can be used in DeFi on supported platforms, where it may appear in liquidity pools, structured yield products, stablecoin swap routes, or collateralized lending markets such as those on Uniswap or PancakeSwap. Always review smart contract security and liquidity depth before depositing AMZNON into any DeFi protocol.