The goal of trading is simple: make profits. But every trader also knows losses are inevitable, especially in volatile markets like crypto and stocks. That’s why

risk management is crucial. Among the most effective tools for controlling downside risk are stop-loss orders and stop-limit orders.

A stop-loss order ensures your trade is closed once the price hits a certain level, guaranteeing an exit. A stop-limit order provides more control over the execution price but doesn’t guarantee the trade will go through. Together, these orders allow traders to protect profits, manage risk, and trade with greater confidence.

What Is a Stop-Loss Order?

A stop-loss order is designed to automatically close a trade once the market hits a predefined level, known as the stop price. At that point, it converts into a market order and executes at the next available price.

• In a long position (buy first, sell later), the stop-loss is placed below the market price. If the price falls to that level, the order sells to prevent deeper losses.

• In a short position (sell first, buy later), the stop-loss is placed above the market price. If the price rises, the order buys back to cap potential losses.

What Are the Pros and Cons of Using Stop-Loss Orders?

Stop-loss orders guarantee execution, making them a powerful safeguard against losses. However, in highly volatile markets, the fill price may be worse than expected, and short-term price swings can sometimes trigger them prematurely.

Pros of Stop-Loss Orders

• Guarantees execution: Once triggered, the order will always be filled.

• Protects profits: By moving the stop level upward as the market rises, traders can lock in gains.

• Saves time: Reduces the need to constantly monitor trades.

Cons of Stop-Loss Orders

• No price guarantee: In highly volatile markets, the execution price may be worse than the stop price due to slippage.

• Can trigger too early: Short-term price swings may activate the stop before the longer trend plays out.

Types of Stop-Loss Orders: Sell Stop and Buy Stop

Stop-loss orders can be set up in two main ways depending on whether you are holding a long position or a short position.

1. Sell Stop Order (for Long Positions)

A sell stop order is placed below the current market price and is designed to protect long positions. If the price falls to the stop level, the order triggers a market sell order, automatically closing your trade to limit downside risk.

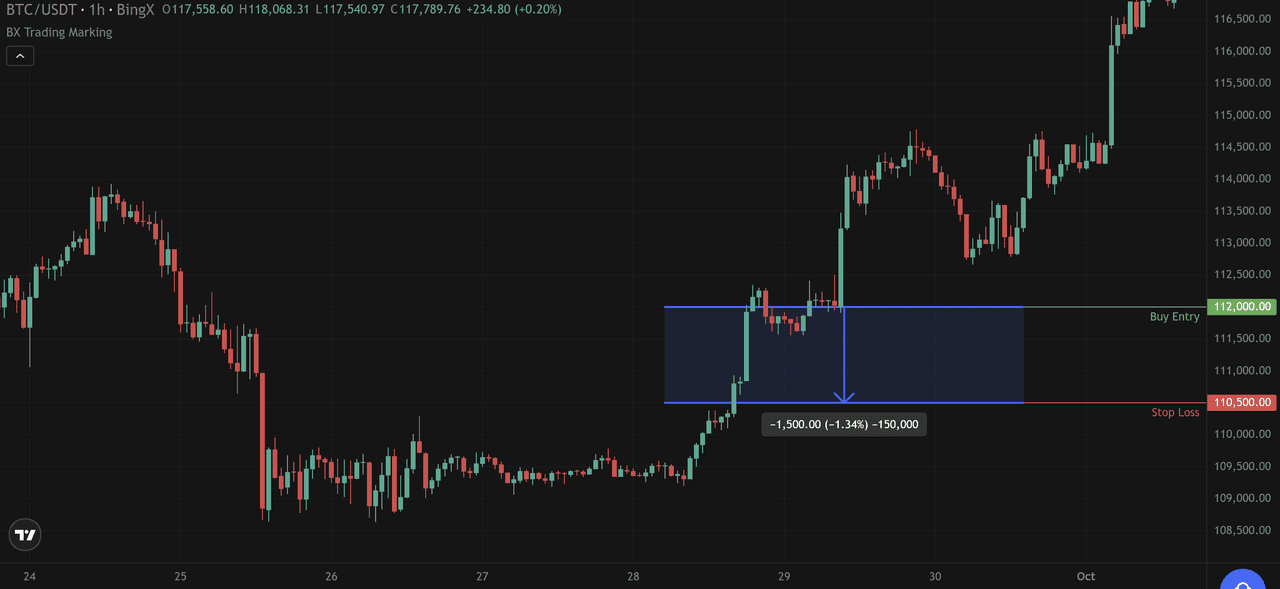

For example, you buy Bitcoin at $112,000 and place a sell stop at $110,500. If BTC drops to $110,500, the stop-loss triggers, capping your loss at $1,500 per coin.

2. Buy Stop Order (for Short Positions)

A buy stop order is placed above the current market price and is designed to protect short positions. If the price rises to the stop level, the order triggers a market buy order, closing your short before losses increase.

For example, you short Ethereum at $4,200 and place a buy stop at $4,300. If ETH climbs to $4,300, the stop-loss triggers, limiting your loss to $100 per coin.

• Sell Stop = Protects long trades when price drops.

• Buy Stop = Protects short trades when price rises.

Both order types give traders an automatic safety net, ensuring they don’t need to constantly monitor market conditions.

How to Use Stop-Loss Orders in Crypto Trading

In crypto, stop-losses are not optional, they’re essential. Bitcoin can swing thousands of dollars in minutes, and altcoins are even more volatile. Without stop-loss protection, traders risk losing their capital in a single move.

Imagine buying BTC at $112,000 and setting a stop-loss at $110,500. If the market suddenly crashes, your position will close automatically, limiting the damage. Without it, losses could spiral much deeper.

How to Spot the Right Place for a Stop-Loss

Placing a stop-loss at the wrong level can cause unnecessary exits. Traders often use these methods to choose better levels.

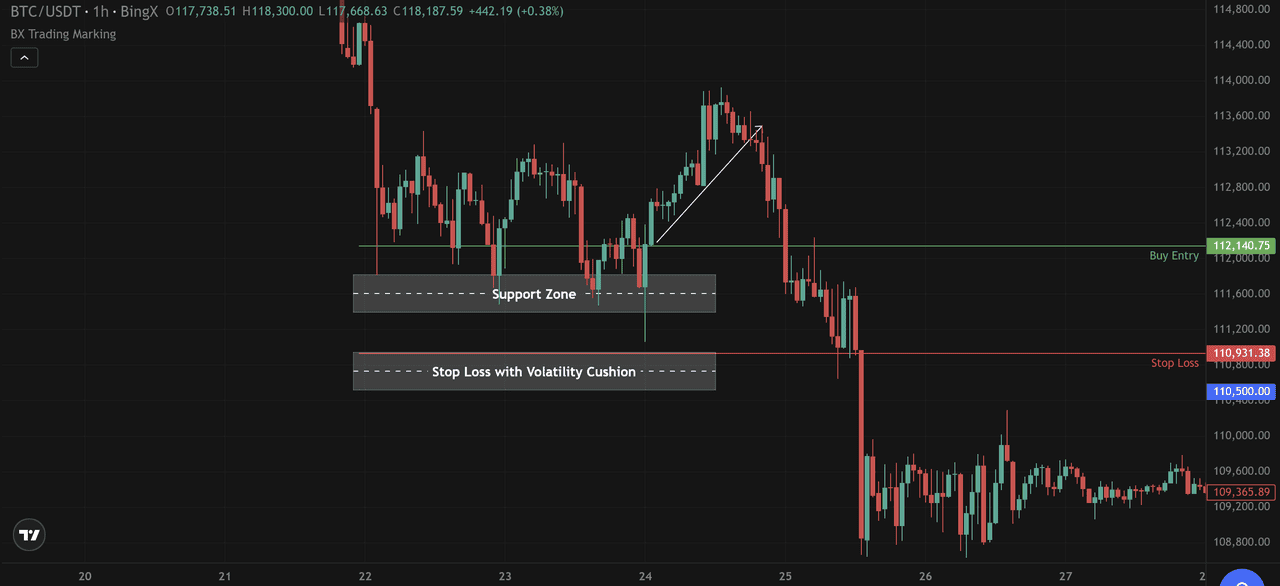

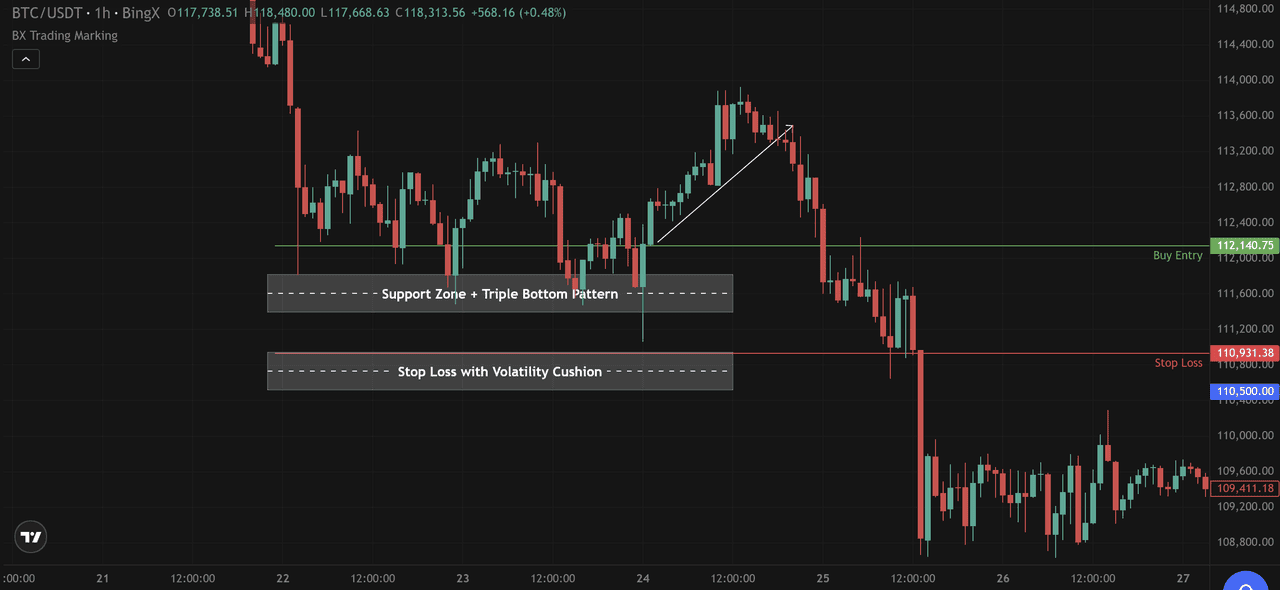

• Support and Resistance: Set stops just below recent

support in an uptrend or just above resistance in a downtrend.

• Volatility Cushion: In highly volatile markets, allow extra “breathing room” so normal fluctuations don’t trigger your stop prematurely.

What Is a Stop-Limit Order?

A stop-limit order combines two elements: a stop price that activates the order, and a limit price that specifies the minimum (for sells) or maximum (for buys) at which you’re willing to trade.

• Stop Price: The trigger point that activates the order.

• Limit Price: The designated price at which the trade will execute, or better.

This gives traders more control over the execution price compared to a stop-loss. However, unlike a stop-loss, there is no guarantee of execution — if the market price gaps past your limit, the trade may remain unfilled.

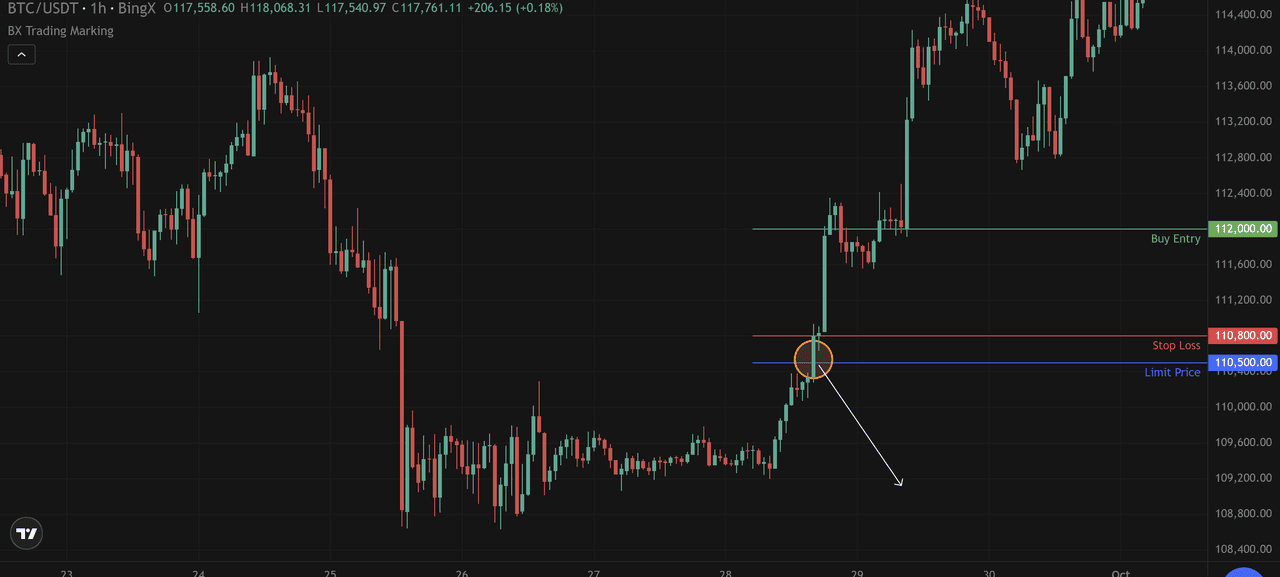

For example, suppose you bought Bitcoin at $112,000 but want protection if the price drops. You set a:

• Stop Price at $110,800

• Limit Price at $110,500

If BTC falls to $110,800, the stop-loss trigger activates and places a limit order. The position will only sell if Bitcoin trades at $110,500 or better. This prevents your trade from executing at a much lower price during a sudden drop.

What Are the Pros and Cons of Using Stop-Limit Orders?

Like any trading tool, stop-limit orders offer distinct advantages but also come with certain trade-offs. They’re ideal for traders who prioritize control over execution but may not suit those who need instant fills during fast-moving markets.

Pros of Stop-Limit Orders

• Price Precision: Executes only at your chosen price or better, avoiding large price deviations.

• Risk Management: Useful for setting well-defined exit or entry levels in volatile markets.

• Strategic Entries: Enables breakout trading strategies without chasing the market.

• No Forced Execution: Unlike stop-losses, you avoid unfavorable fills during sudden spikes or gaps.

Cons of Stop-Limit Orders

• No Guaranteed Execution: If the price gaps past your limit, the order may remain unfilled.

• Requires Monitoring: You must watch market trends to adjust stop and limit levels as conditions change.

• Complex Setup for Beginners: Requires careful calibration of both prices — too tight, and it may trigger prematurely; too wide, and it might not protect you in time.

Stop-Loss vs. Stop-Limit Orders: Key Differences

Although both stop-loss and stop-limit orders are designed to protect traders from steep losses, they operate in fundamentally different ways; understanding these nuances can make a significant difference in volatile crypto markets.

A stop-loss order prioritizes speed and certainty of execution. Once the stop price is hit, it instantly converts into a market order, selling (or buying back) at the next available price. This guarantees that your position is closed, but not at a guaranteed price. In a fast-moving market like Bitcoin, this means you’ll always exit, though the fill may occur several hundred dollars below your trigger level during a sharp drop.

A stop-limit order, on the other hand, prioritizes control over execution price. When the stop price is triggered, it places a limit order that will only execute at the set limit price or better. This prevents selling far below your target level, but it carries the risk that your trade may not execute at all if the market gaps past your limit price, leaving your position open and exposed.

When to Use Stop-Loss or Stop-Limit Orders

The choice depends on your market conditions and risk tolerance:

Stop-Loss Orders Work Best When:

• You’re managing highly volatile assets like BTC or SOL.

• You prioritize exiting the position no matter what, even if the fill is slightly worse.

• You’re using BingX’s Guaranteed Price (GTD) feature — which removes negative slippage and executes exactly at your chosen level, combining the safety of stop-loss with the precision of a stop-limit.

Stop-Limit Orders Work Best When:

• The market is stable or trending steadily.

• You expect short-term volatility but want to avoid selling into a temporary dip.

• You’re managing precise entry or exit zones — for example, setting a buy stop-limit to catch a breakout above resistance without overpaying.

What Are the Benefits and Limitations of Stop Orders?

Stop orders are among the most effective tools for disciplined trading. They help automate exits, reduce the need for constant monitoring, and keep emotions out of the decision-making process. By setting clear thresholds, traders can manage their risk tolerance more effectively, ensuring they don’t hold onto losing trades longer than necessary. They also allow profits to be protected, particularly when stops are adjusted upward in a rising market.

However, stop orders are not perfect. Stop-loss orders may execute at worse prices in highly volatile markets. A sudden drop can trigger the stop, and the order might fill several points below the intended level due to slippage.

Stop-limit orders solve the price-slippage problem but introduce another risk: if the market moves too quickly and bypasses the limit, the order may never execute. In those moments, traders could be left exposed, precisely when protection was most needed.

Conclusion: How to Choose the Right Stop Order

Both stop-loss and stop-limit orders are vital risk management tools. A stop-loss is best when certainty of execution is the priority, especially in volatile conditions. A stop-limit suits traders who want price precision, even if it means the order might not fill.

Used wisely, often in combination, these orders allow traders to limit losses, protect profits, and maintain discipline in unpredictable markets.

Related Reading

FAQs on Stop-Loss and Stop-Limit Orders

1. What is a stop-loss order in trading?

A stop-loss order is an instruction to automatically sell or buy once the market reaches a specific price level, helping traders limit losses and manage risk.

2. What is a stop-limit order?

A stop-limit order combines a stop price and a limit price. Once the stop is triggered, the order becomes active but will only execute at the specified limit price or better.

3. Do stop-limit orders guarantee execution?

No. Stop-limit orders guarantee price control, but if the market moves past the limit without trading at that level, the order may remain unfilled.

4. Which is better: stop-loss or stop-limit order?

It depends on your strategy. Stop-loss orders are better when fast execution matters, especially in volatile markets. Stop-limit orders are better when controlling the execution price is the priority.

5. Should crypto traders always use stop orders?

Yes. Given the extreme volatility of cryptocurrencies, using stop orders is one of the most effective ways to protect profits and avoid large unexpected losses.