The corporate world is increasingly embracing cryptocurrencies as part of their treasury reserves, and

BNB (Binance Coin) is emerging as a standout choice alongside industry giants like

Bitcoin and

Ethereum. This growing trend highlights a broader shift in how businesses manage their assets, driven by the need for diversification, protection against fiat currency volatility, and exposure to blockchain innovation.

BNB’s appeal lies in its active role within blockchain ecosystems and its expanding use cases across payments, decentralized finance (DeFi), and Web3 applications. Rather than being purely speculative, BNB is leveraged by companies as both a hedge and a strategic asset that aligns with innovation in the digital economy.

As more organizations explore digital assets for their treasuries, BNB’s role in corporate finance is expanding, signaling a gradual shift toward integrating blockchain into traditional asset management strategies.

What Is a BNB Corporate Treasury?

A BNB corporate treasury refers to the practice of holding Binance Coin (BNB) as part of a company’s reserve assets, alongside or instead of traditional holdings like cash, bonds, or commodities. Similar to how firms have adopted Bitcoin and Ethereum for treasury diversification, BNB is now being incorporated as a strategic asset due to its expanding utility and strong network fundamentals.

Unlike passive holdings, a BNB treasury can actively integrate with a company’s operations. For firms engaged in blockchain, payments, or Web3 services, BNB holdings can reduce transaction costs, provide liquidity for on-chain activities, and align with long-term technology strategies.

Advantages of a BNB Corporate Treasury

• Diversification Beyond Traditional Assets: BNB allows companies to diversify away from fiat exposure, reducing risk from currency devaluation and inflation.

• Strong Liquidity and Market Depth: As one of the top cryptocurrencies by

market capitalization, BNB offers deep liquidity, enabling firms to enter and exit positions efficiently.

• Utility Across Multiple Use Cases: Beyond being a reserve asset, BNB serves as a functional token in payments, decentralized finance (DeFi), and Web3 applications, giving treasury holdings added strategic value.

• Deflationary Mechanism: BNB’s regular token burns reduce its

circulating supply, potentially supporting long-term price appreciation and enhancing its appeal as a store of value.

• Ecosystem Integration: Companies that work with blockchain technologies can benefit from holding BNB to strengthen partnerships, access ecosystem incentives, and signal alignment with innovation.

A BNB corporate treasury is not just a hedge against traditional financial risks. It is also a tool for companies to engage with the evolving digital economy. This combination of utility and strategic alignment makes it an increasingly attractive option for businesses exploring next-generation treasury strategies.

The Rise of BNB as a Corporate Treasury Asset in 2025

Cryptocurrency adoption by corporations has entered a new phase in 2025. What began as isolated

Bitcoin purchases by pioneering firms has evolved into a broader strategy where multiple digital assets are being added to balance sheets. Among these, BNB is emerging as a key player, benefiting from the momentum of the corporate crypto movement and the growing trend toward multichain treasury diversification.

1. The Foundation: Corporate Cryptocurrency Adoption Surge

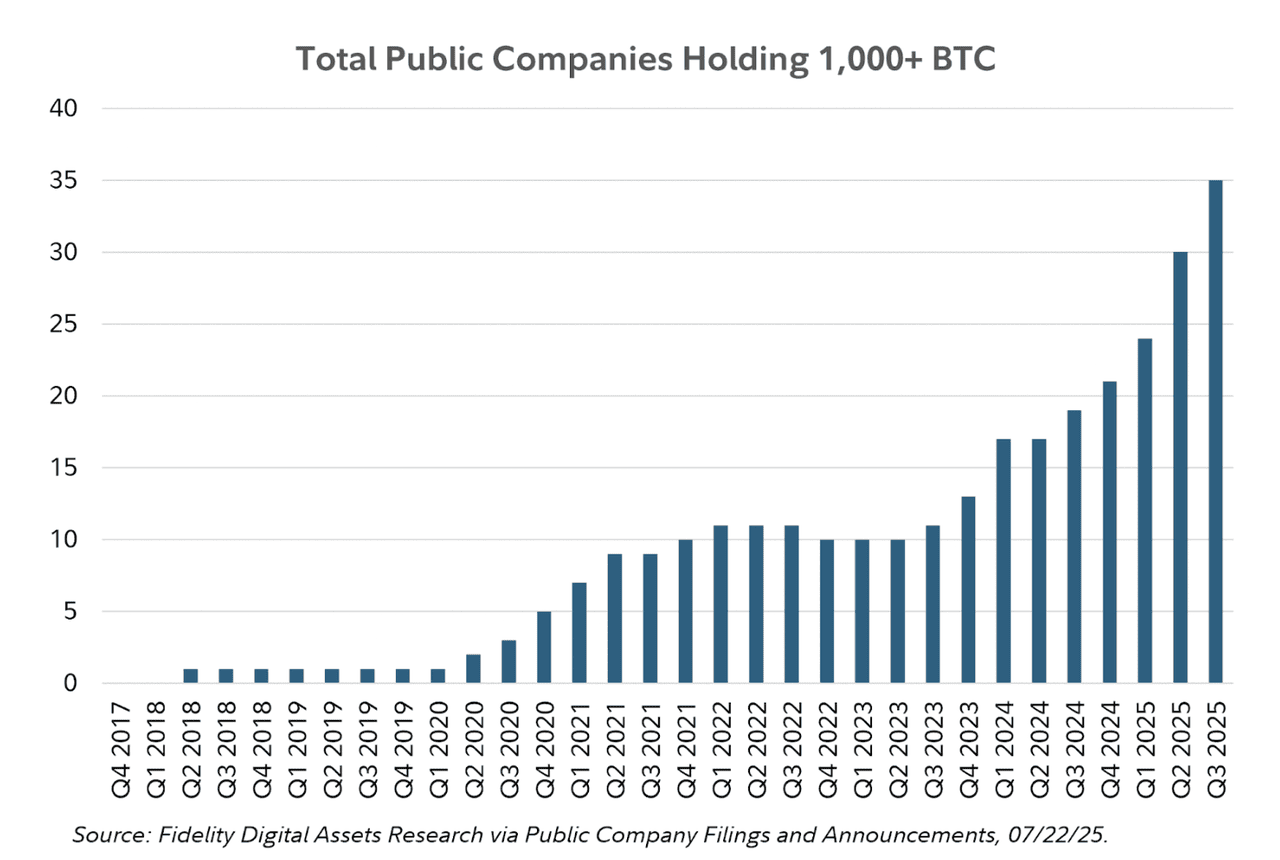

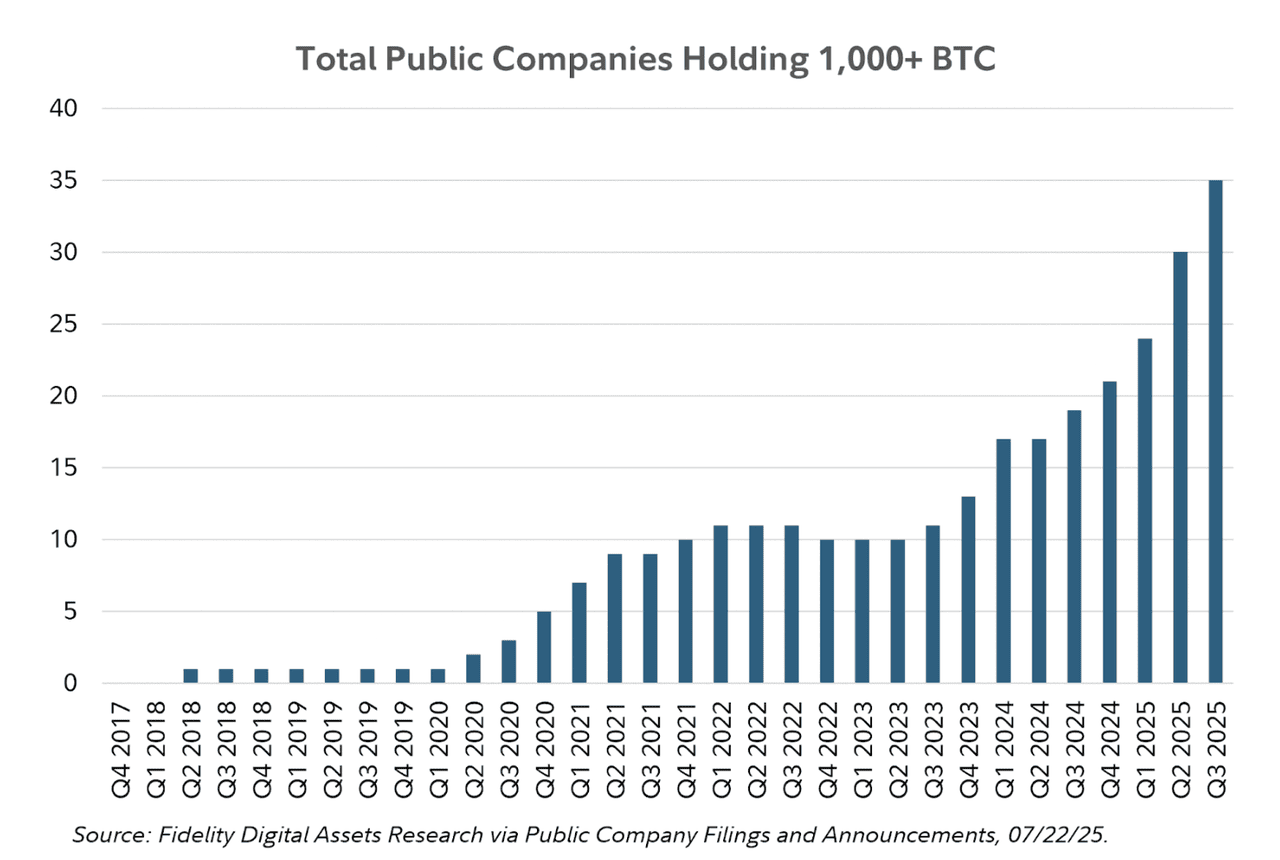

Source: Fidelity

Corporate adoption of Bitcoin is accelerating, with 35 publicly traded companies now holding at least 1,000 BTC each, up from 24 at the end of Q1 2025, according to Fidelity Digital Assets. These holdings exceed $116 billion, reflecting the growing popularity of cryptocurrency as a treasury asset. This trend follows the

Strategy (former MicroStrategy), whose aggressive Bitcoin accumulation set the blueprint for corporations seeking both capital appreciation and a hedge against inflation.

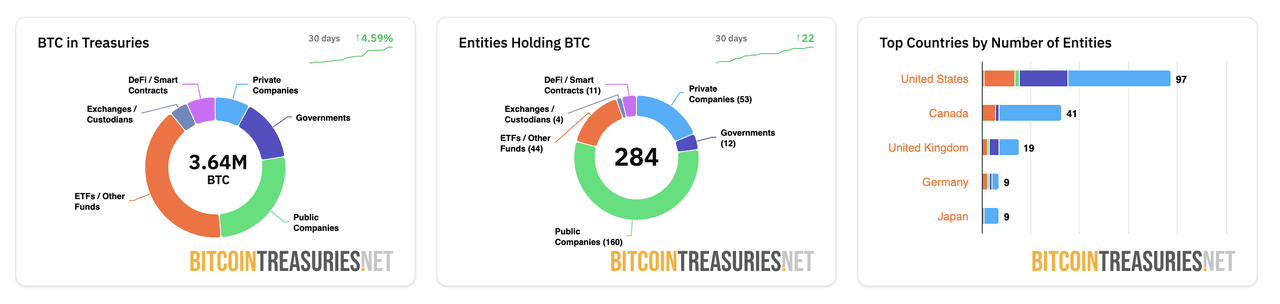

The movement is no longer concentrated among a few large holders. Data from BitcoinTreasuries.NET shows over 284 public entities currently hold Bitcoin, more than double the 124 recorded just weeks ago. Total corporate purchases climbed 35% quarter-over-quarter, from 99,857 BTC in Q1 to 134,456 BTC in Q2 2025. Fidelity notes that buying activity is now more widely distributed across firms, highlighting a shift toward broader institutional participation in Bitcoin treasury strategies.

Source: Bitcointreasuries.net

This surge, supported by regulatory clarity such as President Trump’s executive order establishing a

federal strategic Bitcoin reserve, has created the infrastructure and precedent that now enables BNB to emerge as a corporate treasury asset.

2. The Multichain Evolution: Beyond Bitcoin-Only Strategies

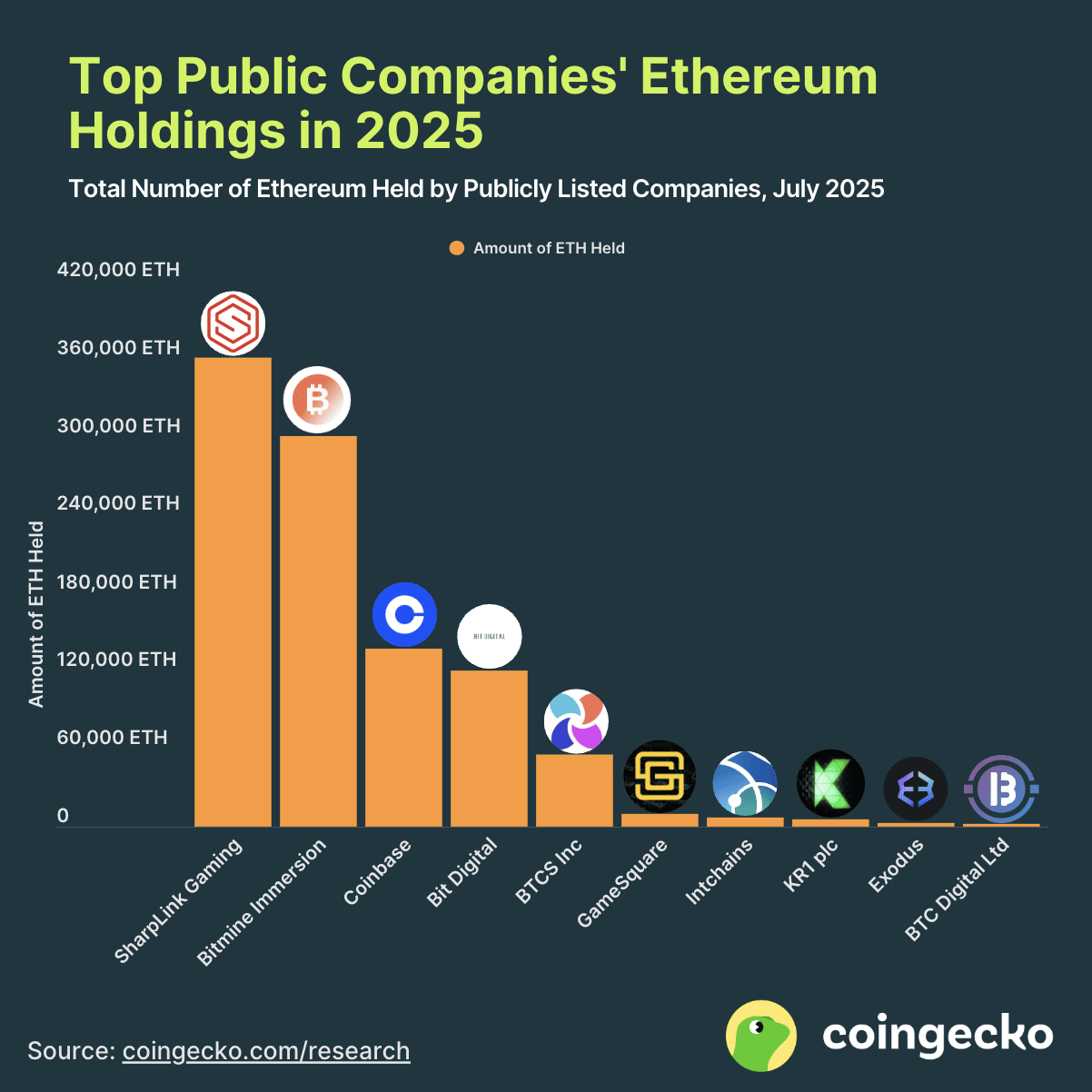

SharpLink has acquired 200,000 more ETH by July 30, 2025 | Source: Coingecko, July 24 2025

The trend builds on the success of Bitcoin treasury strategies pioneered by early adopters and is now evolving into a multichain approach. Ethereum has become the leading alternative, with over 85 public companies holding ETH in their reserves, representing 1.9% of its circulating supply, up from 0.7% in 2023. Unlike Bitcoin,

Ethereum offers staking yields and DeFi tools, making it appealing to companies seeking both capital appreciation and income. Many firms actively stake ETH rather than hold it passively. SharpLink Gaming and Bit Digital stake 100% of their holdings to earn protocol-level rewards, while BitMine holds more than 560,000 ETH worth over $2 billion, underscoring Ethereum’s role as both a core technology platform and a yield-generating asset.

The multichain approach is extending to other cryptocurrencies. More publicly traded companies are adding

Solana to their treasuries, with firms like DeFi Development Corporation raising funds to purchase SOL and operate validator nodes for additional yield. This diversification reflects growing confidence in a wider range of blockchain ecosystems, with corporate treasury strategies now spanning Bitcoin, Ethereum, Solana, and increasingly BNB.

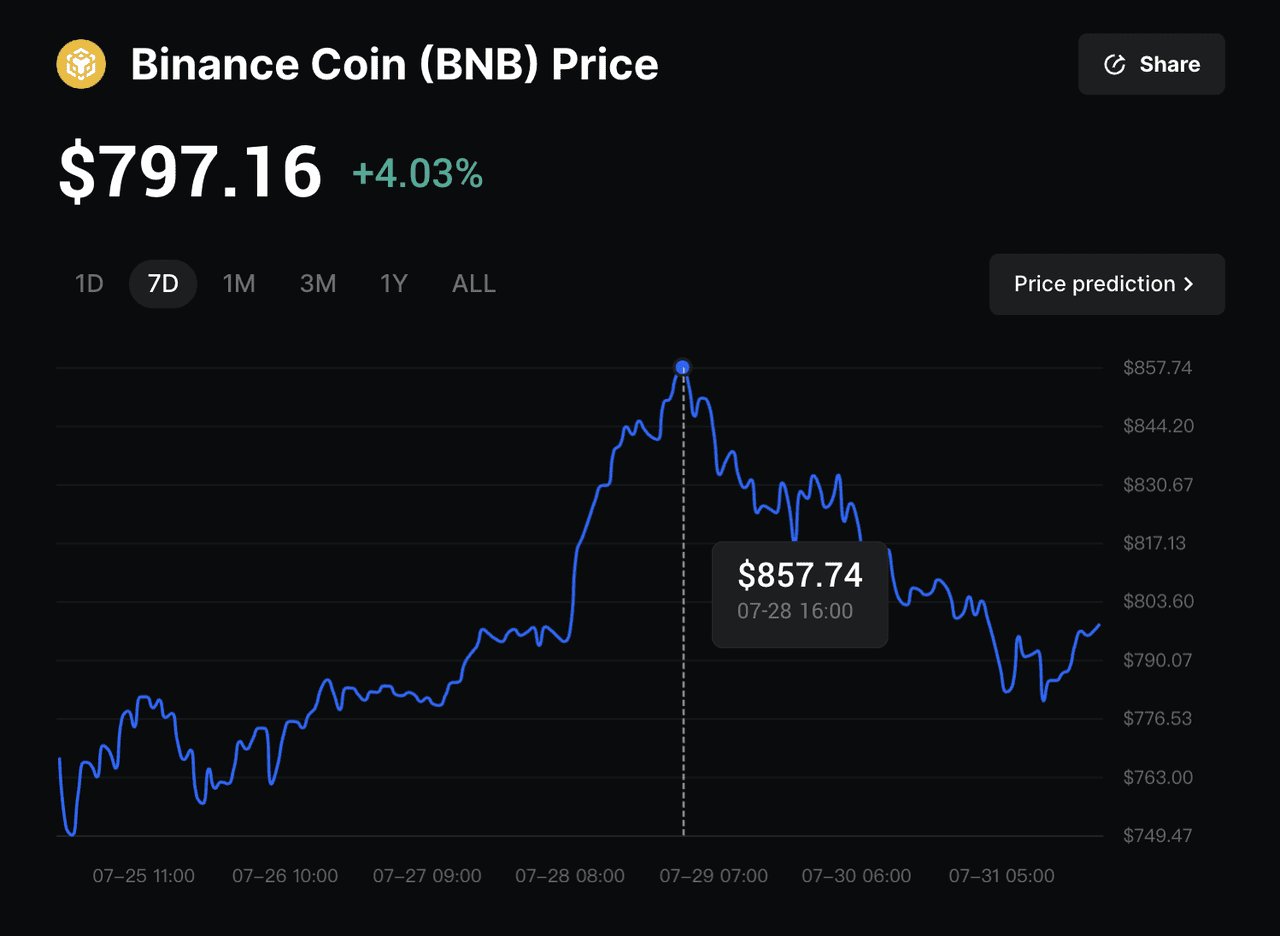

3. BNB’s Strategic Positioning and Institutional Momentum

BNB enters this landscape as a maturing asset with active utility in payments, DeFi, and Web3. Its adoption accelerated in 2025 as Ethereum-driven institutional interest in multichain reserves created favorable conditions for BNB. This momentum grew when Changpeng Zhao (CZ) revealed over 30 teams were preparing public company projects involving BNB reserves. Confidence increased further after BNB hit a new all-time high in July 2025, surpassing $850 on the back of institutional demand and rising on-chain activity.

Market research underscores BNB’s strong risk-adjusted performance, with a five-year Sharpe ratio of 2.5, signaling consistent returns relative to risk. Combined with predictable accumulation by public companies, this supports price stability during volatility. As institutions increasingly favor assets that provide both liquidity and long-term utility, BNB is now positioned alongside Bitcoin and Ethereum as a core component of modern corporate treasury strategies.

Top 5 Largest Public Companies and Entities Holding BNB

The adoption of BNB as a corporate and institutional reserve asset is no longer limited to speculation. In 2025, a growing number of public companies and even sovereign entities have announced plans to add BNB to their treasuries. These moves reflect a strategic shift toward digital assets that combine liquidity, utility, and long-term growth potential. From Bhutan’s national initiatives to major U.S.-listed corporations, the following examples highlight how BNB is becoming a part of forward-looking treasury strategies.

1. Bhutan's Gelephu Mindfulness City

Source: Bhutan Gelephu Mindfulness City (GMC)

Bhutan, a landlocked Himalayan kingdom of 770,000 people nestled between India and China, is the world's first carbon-negative nation that has leveraged its abundant hydroelectric power to become a major cryptocurrency mining player since 2019. Already holding over 13,000 Bitcoin as the fifth-largest nation-state Bitcoin holder globally, Bhutan's expansion into other digital assets represents a natural progression of its innovative digital asset strategy.

In a January 8, 2025 announcement, Bhutan's newly designated Special Administrative Region, known as Gelephu Mindfulness City, revealed plans to formally adopt digital assets, including Bitcoin, Ethereum, and BNB, as part of its strategic reserves. The region aims to establish an urban environment centered around "mindfulness, sustainability, and innovation," leveraging Bhutan's unique position as a bridge connecting South Asia's rapidly growing economies to serve over two billion people in the region.

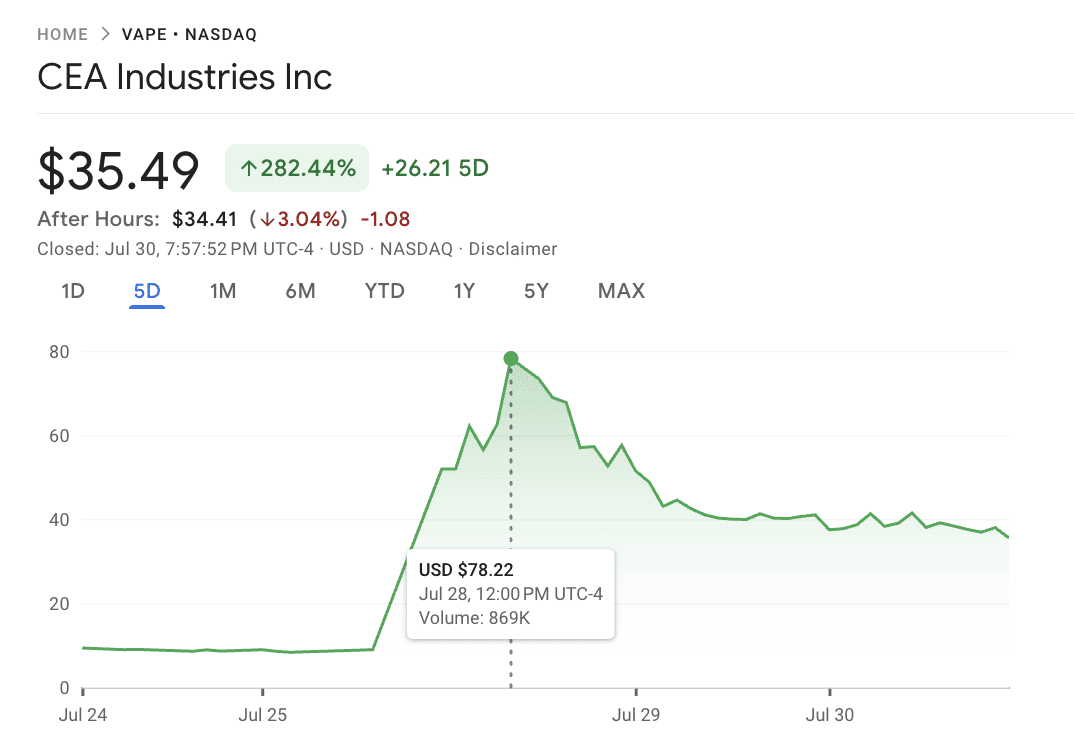

2. CEA Industries (Nasdaq: VAPE)

VAPE stock immediately jumped over 600% on the day of announcing its BNB treasury strategy | Source: Google Finance

CEA Industries Inc., founded in 2006 and headquartered in Louisville, Colorado, is a growth-oriented company that has evolved from controlled environment agriculture services to the high-growth Canadian nicotine vape industry through strategic acquisitions, including the recent $12.6 million purchase of Fat Panda Ltd., which operates 33 retail locations with over 50% market share in central Canada.

On July 28, 2025, CEA Industries announced a $500 million PIPE (Private Investment in Public Equity) to establish the largest publicly-listed BNB treasury strategy in the world. The stock immediately jumped over 600% on the same day. The PIPE has potential to deliver up to $1.25 billion of gross proceeds, consisting of $400 million in cash and $100 million in crypto, plus up to $750 million in cash which may be received from exercised warrants. The initiative is supported by 10X Capital and YZi Labs, with participation from over 140 crypto-native and institutional investors including Pantera Capital and Blockchain.com.

3. Nano Labs (Nasdaq: NA)

Source: Nano Labs X (Twitter)

Nano Labs Ltd, founded by former Canaan executives and headquartered in Hong Kong, is a leading Web 3.0 infrastructure provider that went public in 2022, specializing in high-throughput computing chips and proprietary Cuckoo series technology that serves as alternative ASIC solutions for traditional GPUs.

On June 24, 2025, Nano Labs announced a convertible notes purchase agreement worth US$500 million for its BNB treasury strategy. In the initial phase, the company plans to acquire US$1 billion worth of BNB via convertible notes and private placements, with a long-term goal to hold 5% to 10% of BNB's total circulating supply. The company has already executed on this strategy, purchasing 74,315 BNB tokens for approximately US$50 million, expanding its digital asset reserves to around US$160 million.

4. Windtree Therapeutics (Nasdaq: WINT)

Windtree Therapeutics, Inc., founded in 1992 and headquartered in Warrington, Pennsylvania, is a clinical-stage biopharmaceutical company focused on developing novel therapeutics for acute cardiovascular and pulmonary diseases, with its lead product candidate istaroxime in Phase 2b clinical trials for acute heart failure and cardiogenic shock.

On July 24, 2025, Windtree made a historic financial move by securing up to $520 million to buy Binance Coin (BNB) for its corporate treasury, becoming the first U.S.-listed biopharmaceutical firm to hold BNB directly. The financing comes from a $500 million equity line of credit (ELOC) and a $20 million stock purchase arrangement with Build & Build Corp, with about 99% of these funds designated for BNB acquisition. The company has partnered with Kraken, a leading cryptocurrency exchange, to handle custody, trading, and over-the-counter services for its BNB assets.

5. Liminatus Pharma (Nasdaq: LIMN)

Source: Liminatus Pharma X (Twitter)

Liminatus Pharma Inc., founded in 2018 and based in La Palma, California, is a preclinical-stage biopharmaceutical company that went public in 2025 through a SPAC merger, focusing on cancer immunotherapies with its lead CD47 immune checkpoint inhibitor licensed from South Korean biotech InnoBtion Bio for treating advanced solid cancers.

On July 28, 2025, Liminatus announced plans to establish a dedicated subsidiary named "American BNB Strategy" to lead its digital asset investment initiatives. Through this planned vehicle, Liminatus aims to raise and deploy up to $500 million in phases, targeting strategic, long-term investments in BNB coin as the native token of the Binance ecosystem. According to CEO Chris Kim, "BNB was selected for its active global user base and staking models like Launchpool," emphasizing this as "not a short-term speculative initiative" but a value-driven, long-term strategy that supports the company's broader mission while maintaining its core focus on cancer therapeutics.

Why Are Companies Adding BNB to Their Treasuries?

The decision to add BNB to corporate treasuries comes down to three clear factors: its financial advantages, its operational benefits, and its ability to strengthen strategic positioning in the digital economy.

1. BNB Offers Strong Financial Benefits: BNB combines liquidity, utility, and a deflationary supply model that appeals to corporations seeking resilient assets. It is one of the most actively traded cryptocurrencies, making it easy to manage in large volumes. The regular token burns reduce circulating supply, which supports potential long-term value appreciation.

2. BNB Delivers Operational Utility That Bitcoin and Ethereum Do Not: While Bitcoin is a store of value and Ethereum offers staking yields, BNB provides a balance of low transaction costs, faster settlement, and extensive ecosystem access. Companies using BNB can integrate it into payments, DeFi, and Web3 activities, gaining more than just a static asset on their balance sheets.

3. Holding BNB Strengthens Innovation and Market Positioning: Adding BNB is not only a financial move but also a strategic signal. Companies that hold BNB align themselves with emerging technologies, attract blockchain partnerships, and gain access to ecosystem incentives. This positions them to benefit from the ongoing growth of decentralized finance and Web3 development.

Risks of BNB Corporate Treasury

Despite its advantages, holding BNB as part of a corporate treasury carries several risks that companies must carefully weigh. The most significant is regulatory uncertainty. BNB’s close association with the Binance ecosystem means that any policy shifts, legal actions, or compliance challenges could directly affect its usability and market value. Market volatility is another critical factor, as price swings in cryptocurrency markets can create sudden fluctuations in a company’s balance sheet.

There are also operational concerns. Relying on centralized exchanges for custody or trading exposes firms to counterparty risk, while inadequate security measures increase vulnerability to hacking and theft. Additionally, reputational risk comes into play when a company aligns too closely with a single crypto asset, particularly one tied to a specific platform. To mitigate these risks, companies adopting BNB as a treasury asset must use secure custody solutions, diversify their holdings, and maintain ongoing compliance with evolving regulations.

What’s Next: Future Outlook and Trends for BNB

The adoption of BNB as a corporate treasury asset is still in its early stages, yet the current trajectory points toward a growing role in institutional strategies over the coming years. As regulatory frameworks become clearer and accounting standards for digital assets mature, more companies are likely to gain confidence in integrating BNB into their balance sheets. This development would further solidify BNB’s place within mainstream corporate finance.

Institutional demand is expected to rise as businesses seek blockchain-based opportunities that extend beyond simple asset holding. BNB’s integration into payments, decentralized finance (DeFi), and Web3 services gives it a unique position as both a reserve asset and an operational tool that can enhance corporate strategies. The wave of public companies announcing large-scale BNB acquisitions in 2025 signals the early stages of a broader movement where multichain exposure becomes a standard practice rather than an exception.

Looking ahead, BNB’s future as a corporate treasury asset will largely depend on the sustained expansion of its ecosystem and ongoing institutional participation. If both factors continue to strengthen, BNB is poised to stand alongside Bitcoin and Ethereum as one of the core assets shaping the next generation of corporate treasury management.

Related Reading